In key news on UK stocks, Dr. Martens PLC (GB:DOCS) shares hit another record low after the company warned of a challenging Fiscal 2025 amid U.S. revenue outlook woes. The company foresees its FY24 results aligning with expectations. Nonetheless, looking ahead, it anticipates a double-digit decline in its U.S. wholesale revenues for Fiscal 2025.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

DOCS shares plunged by almost 30% on Tuesday after the company released its trading and outlook update. This also led to a brief suspension of the shares on the LSE.

Dr. Martens is a British brand known for its expertise in crafting and selling footwear. The U.S. remains the biggest market for the company.

Dr. Martens’ Ongoing Struggles in the U.S.

According to Dr. Martens’ update, the decline in wholesale revenues is mainly due to the substantial decrease in the company’s order book for autumn and winter, which accounts for half of its wholesale earnings in the region. This decline is expected to have a notable impact of £20 million on pre-tax profit (PBT).

Overall, the company anticipates a single-digit percentage decline in FY25 revenues. This projection is attributed to the inability to offset inflation next year and no plans to implement further price increases. In terms of profitability, Dr. Martens expects PBT to be approximately one-third of the FY24 level in the “worst-case scenario.”

The company will announce its FY24 results on May 30.

Analysts’ Reactions

Post-update, Morgan Stanley analyst Natasha Bonnet confirmed her Hold rating on the stock, forecasting an upside of 12%. Despite the company issuing multiple profit warnings over the last year and a half, she believes investors will gauge their reaction based on the latest outlook warning. She also adjusted her estimates to align with the company’s guidance.

Similarly, analyst Piral Dadhania from RBS Capital feels the markets are expected to concentrate on the 2025 guidance in the short term, leading to negative sentiment around the stock. The analyst further stated that as consumers are feeling the impact of inflation, there could be a shift towards lower-priced options within the footwear category. Dadhania has a Hold rating on DOCS stock with a prediction of 27% upside.

Are Dr. Martens Shares a Buy?

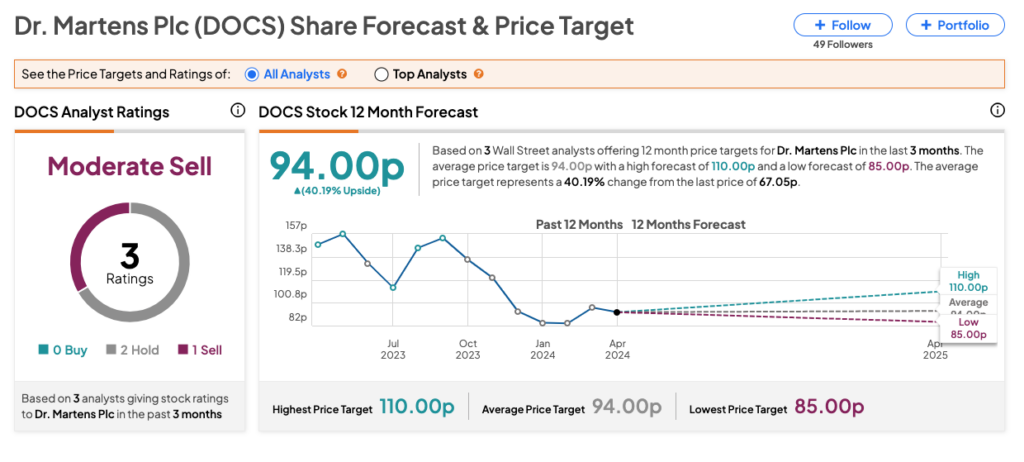

According to TipRanks’ analyst consensus, DOCS stock has a Moderate Sell rating based on two Holds and one Sell recommendation. Dr. Martens share price forecast is 94p, which is 40% above the current price level.