In major news on UK stocks, Diploma PLC (GB:DPLM) shares soared by 5.5% as of writing after the company delivered robust first-half results for FY24 and also upgraded its forecast for the full year. The company reported a 10% year-over-year growth in its reported revenue of £638.3 million in the first half, driven by higher volumes and acquisitions. This growth incorporates an 8% contribution from acquisitions, partially offset by a 3% impact of currency headwinds.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Following the results, Diploma shares surged to a record high, surpassing the 4,000 mark and leading the FTSE 100 index today as of writing.

Diploma supplies specialized technical products and services across the United Kingdom, Europe, and North America.

Diploma’s First-Half Performance

In the first half, Diploma’s adjusted operating margin increased by 80 basis points to 19.6% as compared to 18.8% in H123, driven by operational leverage, disciplined cost management, and acquisitions. Adjusted operating profit saw a 14% year-over-year gain to £125.4 million.

Meanwhile, adjusted earnings per share increased by 10% to 65.1p compared to the first half of FY23. With this growth, the company maintained its consistent track record of double-digit growth over the long term.

In terms of outlook, Diploma stated that its momentum is promising in the second half, resulting in raising its full-year guidance. It anticipates constant currency revenue growth of approximately 16%, including 6% organic growth and 10% from acquisitions. It also projects an improvement in operating margin from 19.6% in the first half to approximately 20.5%.

Jefferies Reacts to Diploma’s Results

Analyst Kean Marden from Jefferies noted that the EPS growth exceeded forecasts by 1%. Additionally, while the upgraded revenue guidance aligns with expectations, the margin guidance slightly exceeds estimates. According to Marden, this suggests that the average EPS forecast is likely to rise by low to mid-single digits.

Marden further added that Diploma’s robust performance stands out amidst recent weakness in the distribution sector, indicating that DPLM shares are poised to stabilize and build upon recent gains.

Is Diploma Stock a Buy?

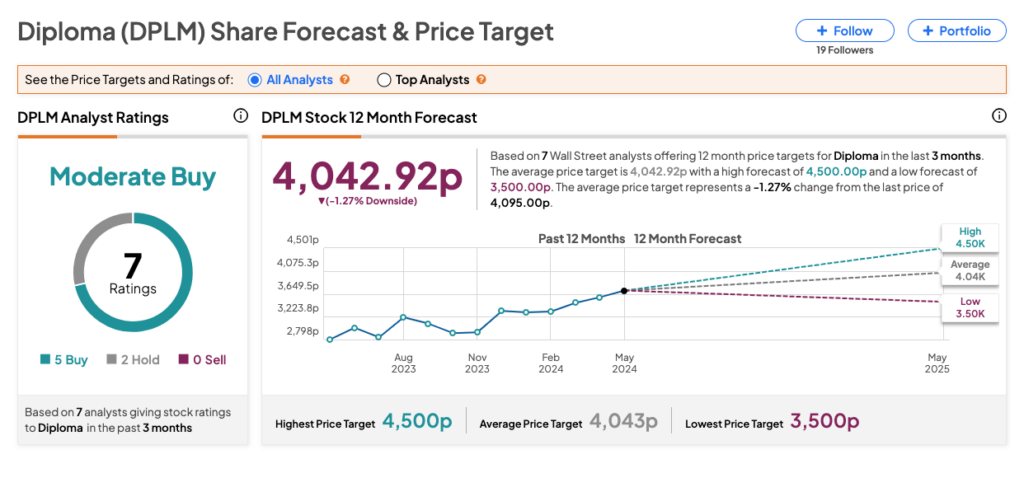

On TipRanks, DPLM stock has received a Moderate Buy consensus rating based on five Buy and two Hold recommendations. The Diploma share price target is 4,042.92p, which implies a downside of 1.27% at the current price level.