The FTSE 100-listed retail company Burberry Group PLC (GB:BRBY) shares declined over 3% as of writing after the company warned of a challenging outlook in its preliminary results for Fiscal 2024. The company’s full-year results fell short of its initial projections mainly due to a slowdown in demand for luxury products. As a result, Burberry expects a challenging first half in FY25, with wholesale revenue projected to decline by approximately 25%. The wholesale revenue in FY24 fell by 5% on a constant currency basis.

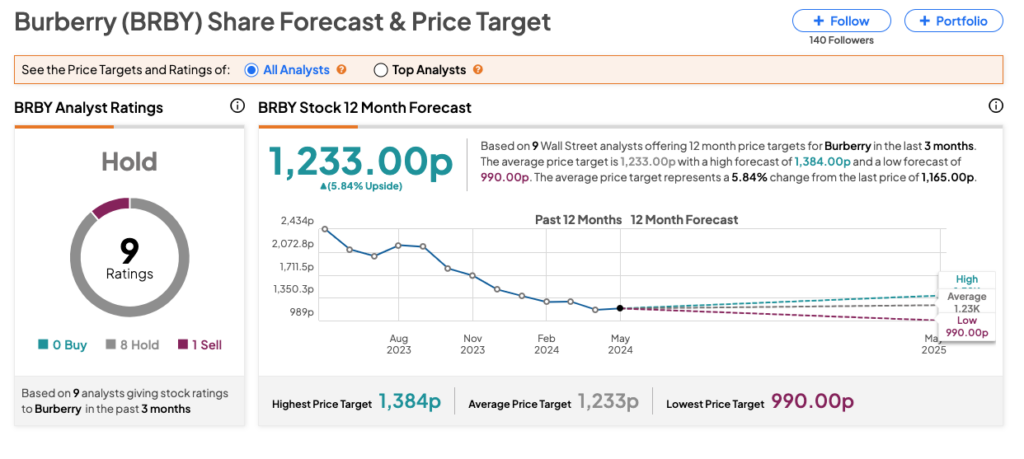

In the last 12 months, BRBY stock has lost over 50% of its value amid a cautious outlook on the luxury goods sector.

Burberry Group is a prominent global luxury brand for clothing, footwear, and accessories across various international markets.

Burberry’s Performance in FY24

For the full year, Burberry’s revenue remained steady at £2.97 billion, at CER (constant exchange rates). However, on a reported basis, revenue was down 4% year-over-year. Comparable store sales saw a 1% decline, as the robust 10% growth in the first half was more than offset by a challenging second half with an 8% decline.

Regionally, the company’s comparable sales were hit hard by its performance in the fourth quarter. Asia Pacific’s comparable store sales demonstrated a 3% year-over-year growth in the full year, despite experiencing a significant 17% decline in the fourth quarter. Meanwhile, the Americas and China witnessed a 12% and 19% drop in comparable store sales in Q4, respectively. On the plus side, Japan experienced robust growth, surging by 25% throughout the year and 18% in the fourth quarter. This growth was primarily driven by a rebound in tourist spending, which contributed to half of the region’s sales during the quarter.

Overall, Burberry’s adjusted operating profit declined by 25% at CER to £418 million. Meanwhile, the adjusted profit before tax amounted to £383 million, down from the £613 million recorded in FY23.

Speaking of shareholder returns, the company proposed a final dividend of 42.7p per share, resulting in a full-year dividend of 61p, which is in line with the previous year.

Are Burberry Shares a Good Buy?

BRBY stock has received a Hold rating on TipRanks, backed by nine recommendations from analysts, including eight Holds. It includes eight Holds and one Sell rating. The Burberry share price target is 1,233p, which is 6% higher than the current trading level.