In key news on UK stocks, energy giant BP PLC (GB:BP) reported disappointing Q1 profits due to lower oil and gas prices and weaker fuel margins. The company reported a 40% year-over-year drop in its underlying RC (replacement cost) profit of $2.7 billion. Additionally, BP’s profit attributable to shareholders fell to $2.3 billion in Q1, marking a notable decline from $8.2 billion in the corresponding period last year. BP shares were down 0.65% as of writing.

BP is a multinational energy company involved in the exploration, production, and distribution of oil and natural gas.

Insights from BP’s Q1 Results

Overall, BP’s results were impacted by lower energy prices and the effects of the outage at its Whiting refinery in Indiana. However, these impacts were partially mitigated by a robust oil trading outcome, increased refining margins, and higher oil and gas output. In Q1, the upstream production grew by 2.1% year-over-year. For the second quarter, the company expects its upstream production to be slightly lower than the first quarter.

BP also stated that it is focused on simplifying the company’s structure to deliver at least $2 billion in cash cost savings by the end of 2026. This will include achieving supply chain efficiency, digital transformation, and improving portfolios.

BP Maintained Shareholder Returns

Despite reduced profits, BP upheld its commitment to strong shareholder returns. The company declared a quarterly dividend of 7.27 cents per share, an increase from 6.61 cents in the first quarter of 2023. Additionally, it initiated a $1.75 billion buyback as part of its $3.5 billion program for the first half of 2024.

UK-based investment management firm Quilter Cheviot praised the share buyback and dividend growth, interpreting it as a positive sign that reflects the company’s confidence in its future earnings, despite the volatility of the commodity markets.

Is BP Stock a Good Buy Now?

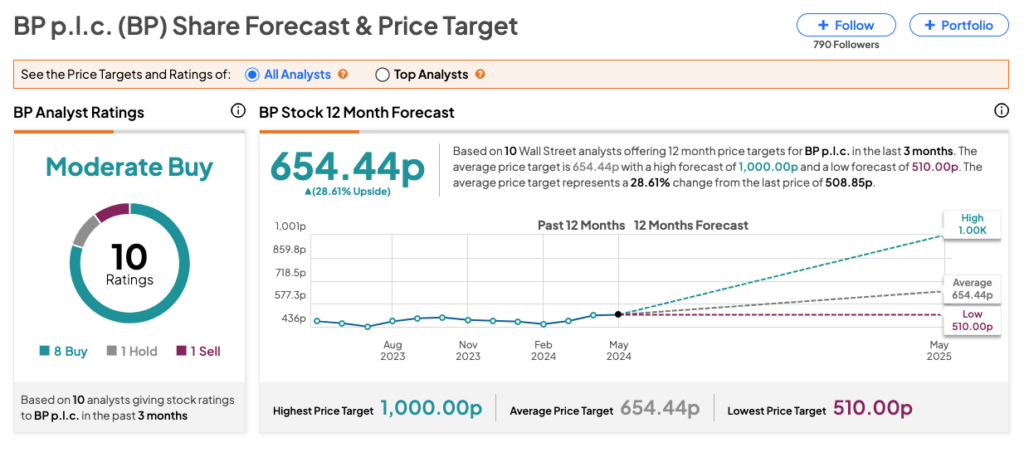

According to TipRanks consensus, BP stock has received a Moderate Buy rating based on eight Buys, one Hold, and one Sell recommendation from analysts. The BP share price forecast is 654.44p, which implies a growth rate of 28.6% at the current trading level.