In key news on UK stocks, BP PLC (GB:BP) shares fell by nearly 4% after the oil and gas giant warned of up to $2 billion of impairment charges in its second-quarter trading update. This also includes charges associated with the ongoing review of BP’s Gelsenkirchen refinery in Germany. The company further stated that it expects weak refining margins and oil trading performance, which will impact its Q2 earnings by $500-$700 million.

The company will announce its second-quarter results for FY24 on July 30.

BP is a global energy company engaged in the exploration, production, and distribution of oil and natural gas.

More Details from BP’s Q2 Update

For the second quarter, BP’s upstream production is expected to remain flat as compared to the previous quarter. Meanwhile, in its oil production and operations segment, the company expects a positive impact of between $0.1 and $0.3 billion compared to the previous quarter, driven by improved realizations. This includes the impact of price adjustments affecting BP’s production in the Gulf of Mexico and the UAE.

Regarding margins, BP indicated that refining margins in Q2 will be primarily impacted by weak diesel prices and narrower differentials for North American heavy crude oil.

Analysts’ Reactions

BP’simpairment warning prompted several analysts to reduce their earnings forecasts. Citi analysts reduced their Q2 EPS (earnings per share) estimate by 9%, while Jefferies analysts expect the update would lead to a 20% earnings downgrade.

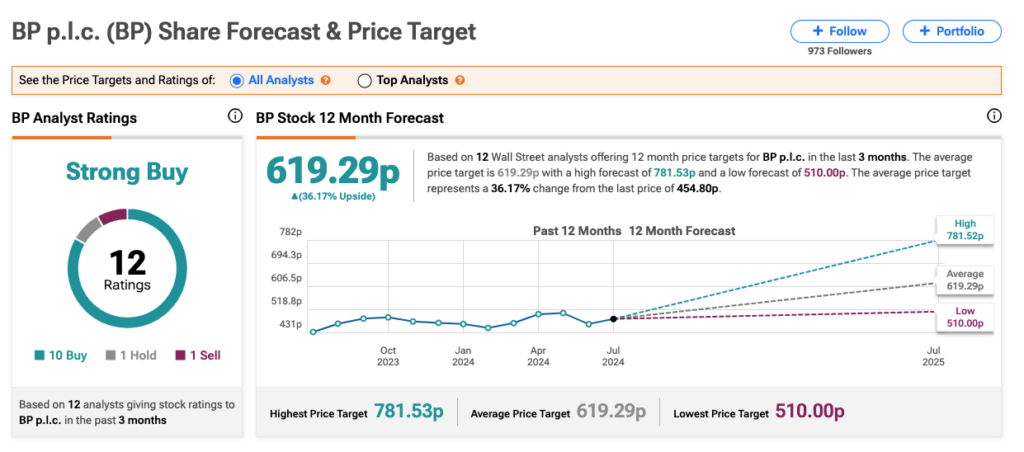

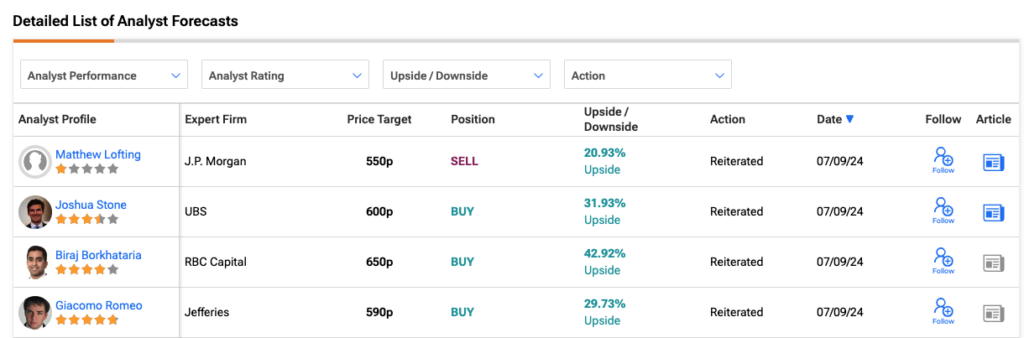

In terms of share price appreciation, analysts remain bullish. Following the update, BP’s stock has received four rating confirmations, including three Buy recommendations. However, J.P. Morgan analyst Matthew Lofting maintained a Sell rating on the stock, predicting a downside of 21%.

Is BP Stock a Good Buy Now?

According to TipRanks consensus, BP stock has received a Strong Buy rating based on 12 recommendations from analysts. The BP share price forecast is 619.29p, which implies 36.2% upside potential at the current trading level.