In major news on UK stocks, British American Tobacco PLC (GB:BATS) (NYSE:BTI) shares fell after the company stated that it expects lower H1 profits due to macro pressures and the rising illegal vapour segment in the U.S. BAT acknowledged that the absence of any legal enforcement over these illegal products is hurting its performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Consequently, the company expects its first-half revenue and adjusted profit from operations to decline by low-single digits on an organic, constant currency basis. BAT shares traded down by 1.23% as of writing. The company will announce its first-half results for FY24 on July 25.

BAT specializes in the manufacturing of cigarettes, tobacco, and nicotine products. The company owns a range of well-known brands, such as Dunhill, Camel, and Newport, and New Category products like Vuse, Glo, and Velo.

BAT’s First-Half Update

For the first half of 2024, in its Combustible category, British American Tobacco delivered a strong performance in pricing, value, and volume share in AME (Asia and Middle East) and APMEA (Asia Pacific, Middle East, and Africa). While, in the U.S., despite recovery signs, the performance was impacted by the implementation of commercial plans in the region.

However, moving forward, the company expects strong momentum in the second half, driven by the expansion of New Category products and the benefits of investments made in the first half in U.S. commercial actions.

British American Tobacco further highlighted that it remains on track to deliver its full-year guidance of low-single-digit growth in revenue and adjusted profit from operations on an organic, constant currency basis. For the full year, the company expects tobacco volumes to be down by around 3% globally.

Is BAT a Good Stock to Buy?

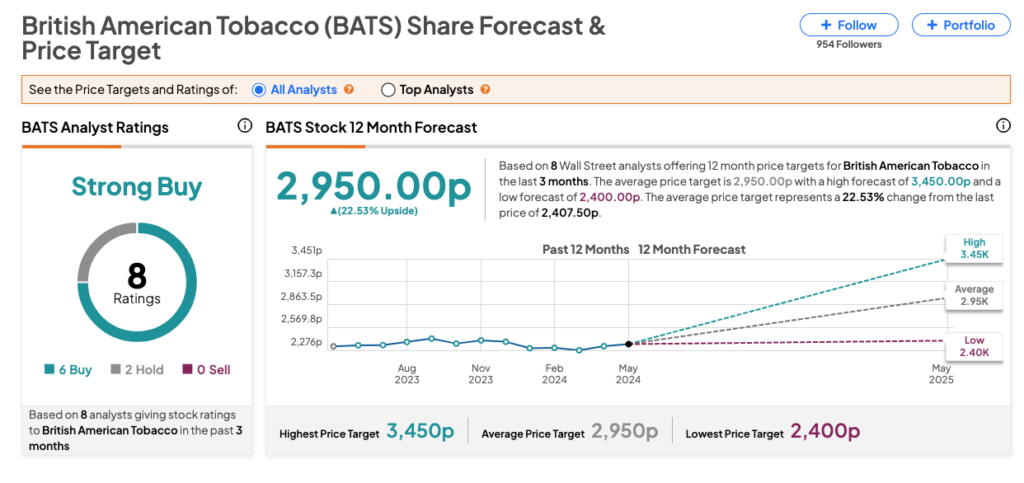

On TipRanks, BATS stock has a Strong Buy consensus rating, backed by six Buy versus two Hold ratings. The BATS share price prediction is 2,950p, which is higher than the current trading levels and implies an upside potential of nearly 23%.