Among the key news on UK stocks, Aviva PLC (GB:AV) shares gained around 1% as of writing after the company announced the completion of its £300 million share buyback programme. The company launched this programme in March 2024 and has acquired 62 million shares at an average price of 478p per share. Over the last three years, the company has paid over £9 billion to its shareholders as capital returns and dividends.

Year-to-date, Aviva shares have advanced 11% in trading.

Aviva is a British insurance company catering to a customer base of more than 11 million. It offers various financial products, including insurance, wealth management, and retirement solutions.

Aviva’s Strong Shareholder Returns

Aviva is known for its strong shareholder returns in the UK market, including dividends and share buybacks. The latest buyback was part of the company’s commitment to consistent and sustainable capital distributions.

The company offers a dividend yield of 7.01%, significantly ahead of the sector average of 2.114%. In May, the company paid its final dividend of 22.3p per share for 2023, leading to a total dividend of 33.4p. This marked an increase of 8% over the previous year’s dividends.

Moving forward, Aviva has upgraded its dividend guidance along with its annual results for 2023. It now expects its cash cost of dividends to grow by mid-single digits. Additionally, the company is targeting an operating profit of £2 billion by 2026.

Meanwhile, Aviva’s Q1 2024 trading update, which was released in May, highlighted a strong beginning to the year. The company kept its full-year outlook unchanged.

Is Aviva a Good Stock to Buy?

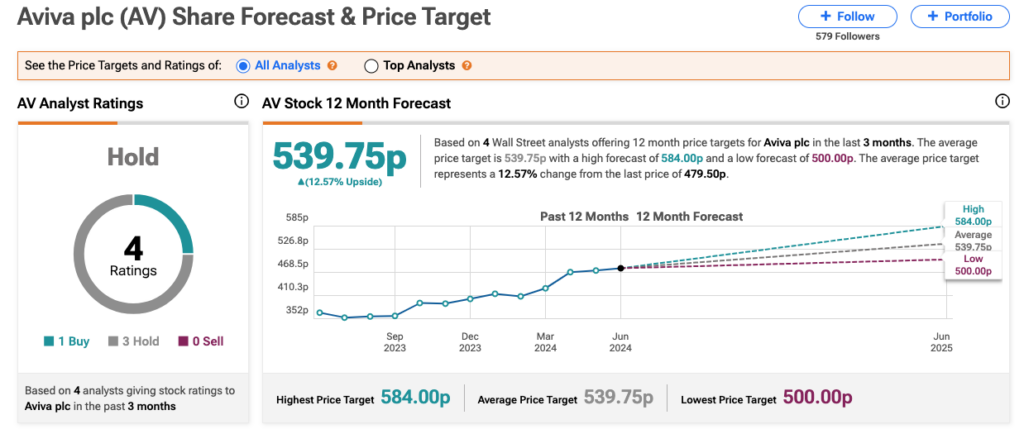

According to TipRanks, AV stock has received one Buy and three Hold ratings from analysts. The Aviva share price forecast is 539.75p, with a high forecast of 584p and a low forecast of 500p. The average price target implies 12.6% upside potential from the current price level.