In news on UK stocks, Aviva PLC (GB:AV) posted strong results for 2023, with a 9% growth in full-year operating profit to £1.47 billion. Moreover, the company announced a new share buyback program for £300 million, bringing the total shareholder returns, including dividends and share buybacks, over the past three years to over £9 billion. AV shares rallied as high as over 6% in Thursday’s early trading. At the time of writing, the stock was trading at a gain of 2.4%.

Aviva is a prominent player in the insurance sector, offering a range of products, including life and general insurance, and asset management.

Highlights from the 2023 Results

Aviva reported a notable 12% increase in solvency II operating own funds generation (Solvency II OFG), amounting to £1.7 billion. The company’s general insurance premiums increased by 13% to £10.8 billion.

Aviva disclosed a 1% decrease in baseline controllable costs to £2.7 billion. This accomplishment enabled the company to surpass its cost reduction target of £750 million one year before its schedule.

Backed by strong growth, the company also announced a final dividend of 22.3p, leading to an 8% increase in its full-year dividend to 33.4p.

In terms of its outlook, Aviva has established an operating profit target of £2 billion by 2026. Solvency II OFG is projected to reach £1.8 billion by 2026, upgraded from £1.5 billion by 2024.

Is Aviva a Good Stock to Buy Now?

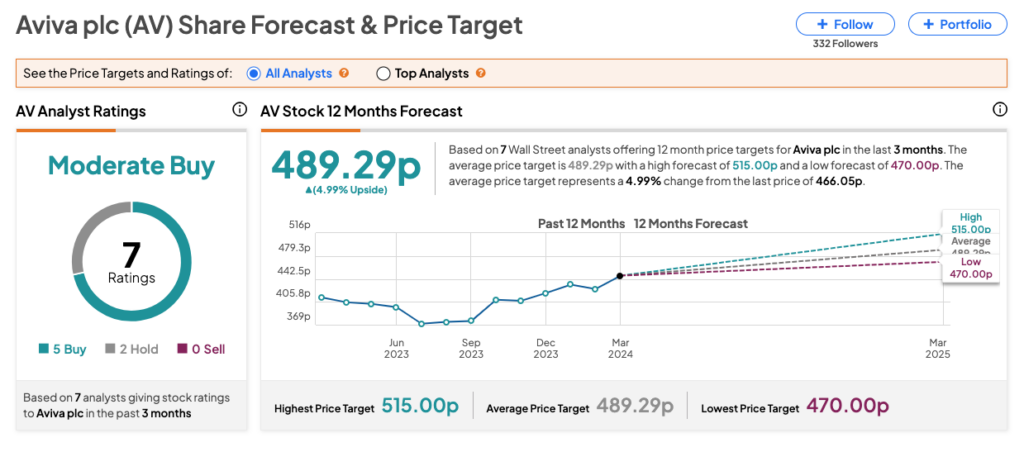

Analysts maintain a positive outlook on AV stock, assigning it a Moderate Buy rating on TipRanks. This is underpinned by five Buy and two Hold recommendations. The Aviva share price forecast is 489.29p, which is 5% above the current price level.