In key news on UK stocks, Anglo American PLC (GB:AAL) has turned down the revised offer of £34 billion ($42.7 billion) from ASX-listed BHP Group Limited (AU:BHP), stating that it still undervalues the company. The offer value represented an improvement over the previous bid of £31 billion ($38.8 billion), which was made last month. Anglo’s shares closed Monday with a decline of 2.16%, while BHP’s current trading shows a decrease of 0.38% as of writing.

BHP is a multinational mining company that produces diverse commodities like iron ore, coal, copper, nickel, and a variety of other minerals. Meanwhile, Anglo American is a prominent producer of platinum, with a product lineup that includes diamonds, copper, and iron ore.

Anglo vs. BHP

Anglo American’s chairman, Stuart Chambers, added that the deal offer once again fails to capture the intrinsic value of the company. On the other hand, BHP believes that the merger of the two companies is a “win-win” and would generate substantial value for all shareholders.

The new offer from BHP values Anglo at £27.53 per share, an increase from around £25 per share in the original offer made last month. Additionally, it represented approximately a 30% premium over Anglo’s share price before the commencement of takeover discussions.

However, the offer still requires Anglo to divest its stakes in iron ore and platinum assets located in South Africa, a condition that the company finds unappealing.

BHP’s Failed Attempts

Last month, BHP proposed an all-share deal to take over Anglo American for $38.8 billion, aiming to establish a dominant presence in the mining sector. Furthermore, BHP seeks to bolster its copper portfolio through this acquisition, given the growing demand for the metal. However, later on, Anglo American rejected the offer, stating that it undervalued the company and failed to garner appeal among its shareholders.

Moreover, the announcement of the deal triggered a backlash from both government entities and Anglo’s shareholders.

Is Anglo American a Good Share to Buy?

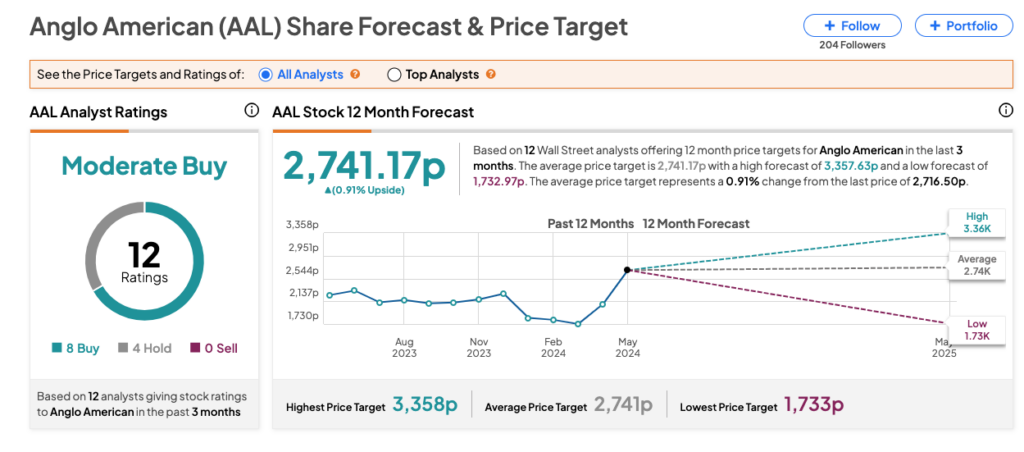

According to TipRanks’ consensus, AAL stock has been assigned a Moderate Buy rating, backed by eight Buy and four Hold recommendations. The Anglo American share price target is 2,741.17p, which is similar to the current trading price.