Among popular UK stocks, shares of leading spirits maker Diageo (GB:DGE) have declined 20% over the past year due to demand slump in key markets like North America and Latin America. While some analysts see the pullback in the stock as an opportunity to buy it for long-term gains, others are sceptical about a potential recovery in the company’s business over the near term.

Diageo’s Business Under Pressure

Diageo, which owns popular brands like Johnnie Walker, Guinness, and Smirnoff, reported a 1.4% decline in its net sales for the First Half of Fiscal 2024 to $11 billion. On an organic basis, sales fell 0.6%, mainly due to a 23% drop in the sales of the company’s Latin America and Caribbean segment and currency headwinds. Moreover, sales in the North America region fell 1.5%.

The company blamed a decline in consumption and consumers’ shift to lower-priced offerings due to macro challenges for the weakness in its Latin America and Caribbean segment and elevated inventory levels.

Despite ongoing macro pressures, the company said that it expects to deliver improved organic net sales and operating profit in the second half of Fiscal 2024 compared to the first half. Additionally, the company maintained its medium-term outlook for organic sales growth in the range of 5% to 7%, with similar growth expected in operating profit.

Analysts’ Mixed Opinions

Analysts who are bullish on Diageo are positive about the company’s long-term growth story, backed by its initiatives to revive its performance and cut costs. In fact, the company’s productivity initiatives helped generate $335 million in cost savings in the first half of Fiscal 2024.

Moreover, Diageo offers a dividend yield of 3.1%. The company hiked its interim dividend by 5% to 40.50 cents per share and executed share buybacks worth $0.5 billion in the first half. The company’s capital returns are backed by strong cash flows. Free cash flow increased by $0.5 billion to $1.5 billion in the first half of Fiscal 2024.

Meanwhile, analysts who have a Hold or Sell rating are concerned about several headwinds. For instance, on June 7, Deutsche Bank analyst Mitch Collett lowered the price target for Diageo stock to £23 from £24 and reiterated a Sell rating.

Collett updated his estimates to reflect a more cautious view of the U.S. and European markets. He expects a notable deterioration in North America’s organic sales growth in the second half of Fiscal 2024. The analyst thinks that it would be prudent for the company to withdraw its medium-term organic revenue growth guidance at the earliest, given the existing pressures and limited visibility.

Is Diageo a Good Stock to Buy?

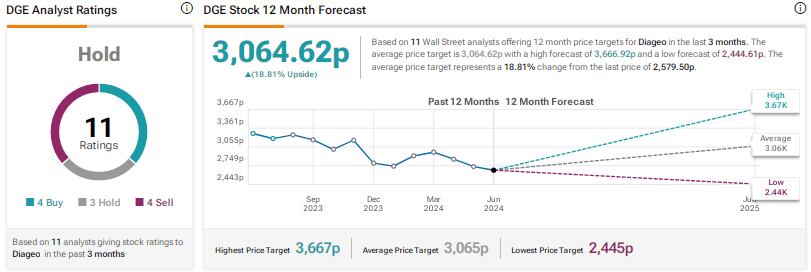

Diageo stock has a Hold consensus rating, backed by four Buys, three Holds, and four Sells. The average DGE share price forecast of 3,064.62p implies 19% upside potential.

Conclusion

Analysts are dividend on Diageo’s growth trajectory. While some are confident about the alcoholic beverage giant’s ability to bounce back, others are concerned about weakness in key markets and continued market share losses.

Questions or Comments about the article? Write to editor@tipranks.com