In key news on UK stocks, 888 Holdings (GB:888) shares soared over 3%, as of writing, after the company surpassed its own revenue guidance for Q1 2024. The company’s revenue amounted to £431 million, slightly ahead of its previously outlined guidance range of £420-£430 million. It also marked an increase of 2% over the previous quarter but was down 3% year-over-year. Moving forward, 888 anticipates its revenue to resume year-on-year growth starting in the second quarter.

Based in the UK, 888 Holdings is a betting and gaming company with a worldwide footprint. The company owns well-known brands such as William Hill, 888casino, 888poker, 888Bingo, and 888sport.

Highlights from 888’s Q1 Trading Update

In its UK and Ireland online segment, 888 experienced a 1% year-over-year decline in revenues despite a 4% growth in gaming. For its international business, Q1 revenues showed continued growth, with a 6% increase compared to Q4 2023. While, in its retail business, revenues decreased by 7% year-over-year, primarily due to shop optimization efforts and tough comparison metrics.

Additionally, 888 revealed a new strategic plan, stating its mid-term financial targets. The company aims to achieve annual revenue growth of 5-9%, while enhancing the adjusted EBITDA margin by approximately 100 basis points annually. 888 also aims to reduce its net debt leverage to 3.5 times or below by 2026.

888 expects to finalize the sale of selected U.S. assets by this year. This sale is projected to result in an annual EBITDA increase of £25 million starting from 2025.

What is the Target Price for 888?

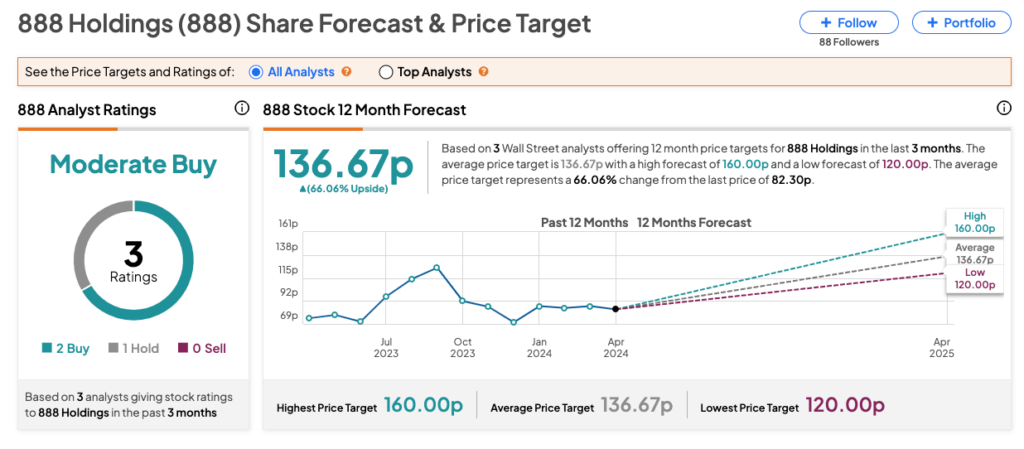

According to TipRanks’ analyst consensus, 888 stock has received a Moderate Buy rating with two Buys and one Hold recommendation. The 888 share price target is 136.67p, which is 66% higher than the current price level.