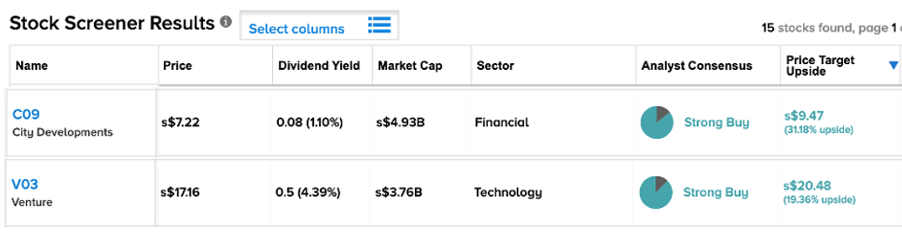

Using the TipRanks Stock Screener tool for the Singapore market, we have shortlisted City Developments (SG:C09) and Venture Corp (SG:V03). Analysts have “Strong Buy” ratings on these two shares with good upside potential for the next year.

As investors fret about 2023, these stocks, backed by experts, offer clear opportunities in the current shaky environment.

Let’s dig deeper into these two companies.

City Developments Limited (CDL)

Based in Singapore, City Developments is a global real estate company with properties at more than 100 locations across 29 countries.

Despite posting higher profits in its 2022 earnings, the stock touched its lowest point of the last year recently. The stock has lost around 12% in the last three months.

The company posted a net profit after tax of S$1.3 billion for 2022, which is its highest-ever number in profits. This solid number was achieved through major divestments, higher sales, and a recovery in its hotel operations. The total revenue for the company increased by 25.4% to S$3.3 billion in 2022, as compared to the previous year.

Analysts are bullish on the company based on a strong rebound in its hotel business riding on a recovery in global travel demand, and its liquidity position. The company ended the year with a cash reserve of S$2.4 billion as of December 2022.

The company’s upcoming residential pipeline, as well as its asset redevelopment, appear to be solid and could provide a significant boost to its total asset value. Analysts believe this is currently not priced into the stock price.

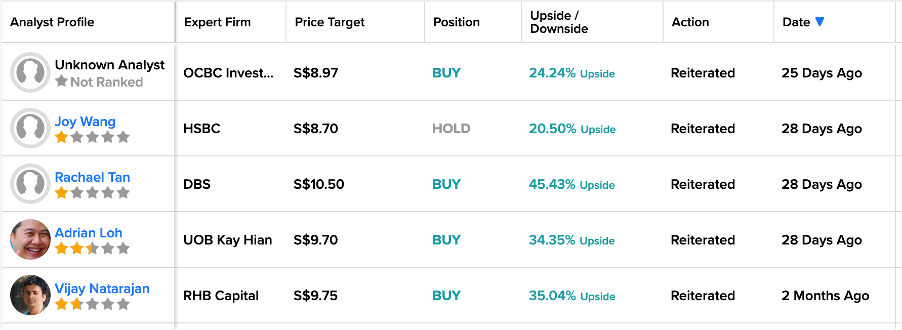

City Developments Share Price Target

Analyst Rachael Tan from DBS has the highest price target on the stock at S$10.5, suggesting an upside of 45%.

Overall, C09 stock has a Strong Buy rating on TipRanks, based on six Buy and one Hold recommendations.

The average target price is S$9.42, which is 30% higher than the current price level.

Venture Corporation Limited

Venture is the leading provider of technology products and services across various industries. The company also provides services like market research, design, supply chain management, etc.

The company reported a 24% increase in revenue to S$3.8 billion in its 2022 annual results. The net profit was up 18% to S$369 million, as compared to S$312 million in 2021. The company’s growth indicated strong customer demand and acceptance of new product launches throughout the year. The company also managed its higher costs and supply chain issues in an efficient manner.

UOB Kay Hian analyst John Cheong, commented on the results, “The strong growth was due to growth across all the domains and its ability to overcome supply-side challenges including global supply chain constraints, rising inflationary pressures, and a tight labor situation.”

Analysts are favoring the stock based on its solid recovery, which is on track. However, they also consider the potential risks of operating in a challenging environment.

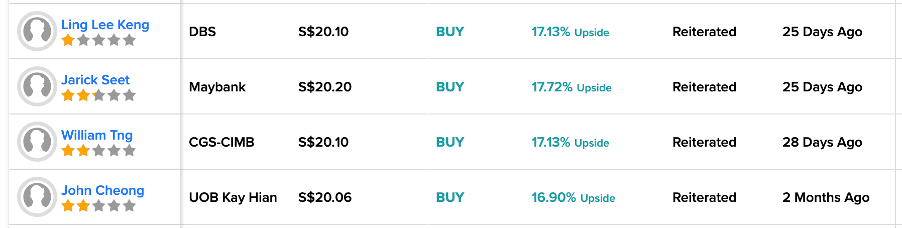

Venture Share Price Target

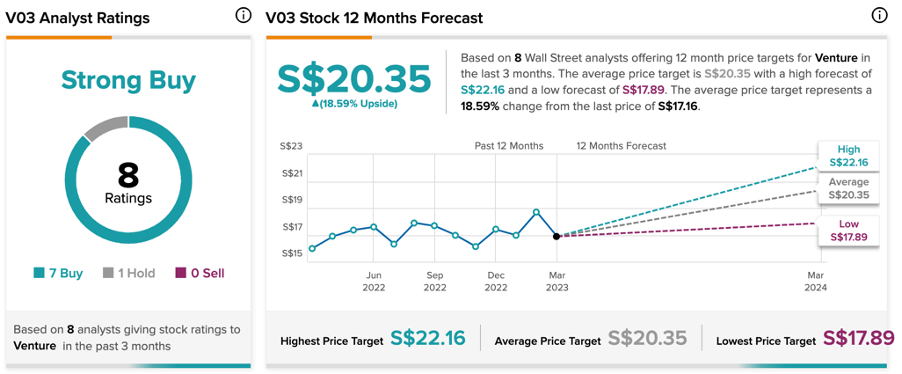

According to TipRanks’ rating consensus, V03 stock has a Strong Buy rating. The stock has a total of eight recommendations, out of which seven are Buy.

The average price target is S$20.35, which is 18.6% higher than the current price level.

Conclusion

These two SGX shares have gotten thumbs up from analysts after reporting such record numbers in their results.

City Developments’ stock offers around 30% growth in its share price, while Venture has an 18.5% upside potential for the next year.