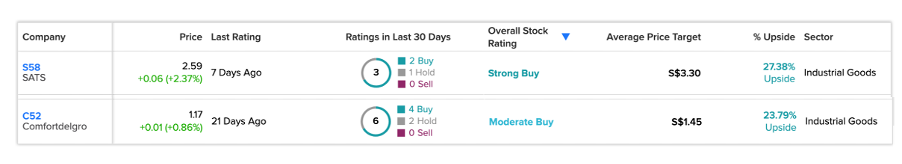

Using the TipRanks Trending Stocks tool for Singapore, we have shortlisted ComfortDelGro (SG:C52) and SATS Ltd. (SG:S58), which are rated Buy by analysts. These companies also have more than 20% forecasted growth in their share prices.

The trending stock tool, which is available in seven different markets on TipRanks, provides a list of recently rated stocks by analysts. The user can screen stocks from this list for further research to make an informed investment decision.

Let’s discuss these companies in detail.

ComfortDelGro Corporation Limited

ComfortDelGro is among the world’s biggest transport companies, with a fleet of around 34,000 vehicles.

Even though the company’s operations are returning to normal after being hit by the pandemic, the stock is still hovering in the red zone. In the last six months, the stock has been trading down by 16.4%.

In February, the company posted its full-year earnings for 2022. The net profit for the year increased by 40% to S$173.1 million, as compared to S$123 million in 2021. The company’s top-line growth was driven by its taxi business, which will be a key factor for future revenues and profitability. In addition, efficient cost management will also be highly important, as the company struggles with high labor and fuel costs.

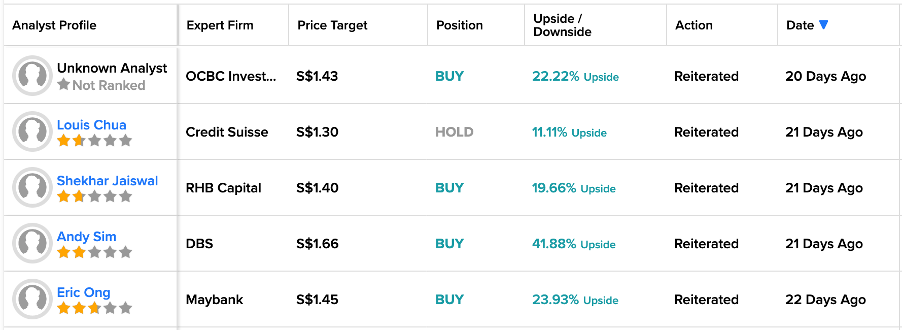

Post-results, analysts have maintained their Buy ratings on the stock. Analyst Andy Sim from DBS has the highest price target of S$1.66 on the stock, suggesting an upside of 41.8%.

Analysts remain bullish on the higher tourist influx from China and higher dividend payments in the future. The total dividend payment for 2022 was S$0.0848 per share, up from S$0.042 per share in the previous year.

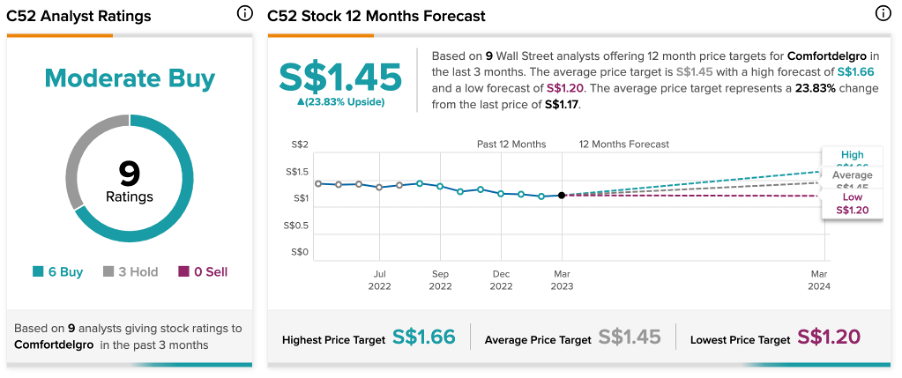

What is the Price Target for ComfortDelGro?

According to TipRanks, C52 stock has a Moderate Buy rating, based on six Buy, and three Hold recommendations.

The average price forecast is S$1.45, which has an upside of 23.83% on the current price level.

SATS Ltd.

SATS is a food services company mainly catering to the aviation sector. The company also provides aviation security, warehousing, passenger services, etc.

In Q3 of the fiscal year 2023, the company’s performance reflected improved business operations. The revenue for the quarter improved by 11% to S$475.7 million as compared to the previous quarter. The previous losses of S$9.9 million were also transformed into a profit of S$0.5 million in the third quarter.

Analysts are confident about the stock, with a rebound in the aviation sector pushing revenues for the company.

SATS Price Target

The company has been trading down by more than 30% in the last six months.

S58 stock has a Strong Buy rating on TipRanks, based on four Buy and one Hold recommendations.

The average target price is S$3.30, which implies an upside of 27.3% on the current price.

Conclusion

Both ComfortDelGro and SATS have reported better numbers, riding high on the recovery in business operations after the pandemic. Analysts are bullish on these stocks as they expect this momentum to continue after the reopening of China.

S58 has a Strong Buy rating, and C52 has a Moderate Buy rating from analysts on TipRanks.