In the midst of market volatility, TipRanks’ tools give investors hope that things will improve in the long run. The Smart Score tool focuses on factors like analyst rating, technical analysis, and others to assign a score on a scale of one to ten, with ten being the best.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

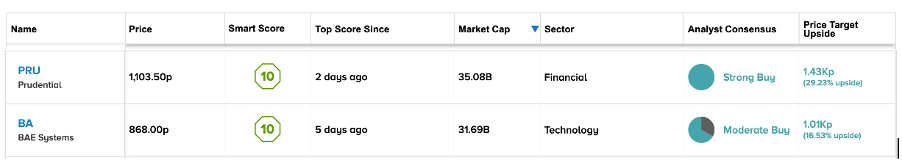

Here, we have used the TipRanks Smart Score tool to list the stocks, Defence giant BAE Systems (GB:BA), and insurance company Prudential (GB:PRU) from the FTSE 100 index, which has recently achieved a perfect score of ten.

On the one hand, BAE Systems shareholders had a great year with high returns, while Prudential shareholders are still awaiting a turnaround in the share price.

Let’s discuss the stocks in detail.

BAE Systems

BAE Systems, a manufacturer of defense and aerospace products, had a good run in the market with 63% returns in the last year. It has been among the top performers on the FTSE 100 index in 2022.

The company benefitted from the outbreak of war between Russia and Ukraine. It witnessed a huge growth in demand for its military equipment, which resulted in its solid operational performance.

With a dividend yield of 3.29% compared to the sector average of 1.03%, the company also checks the box for income investors. In its half-yearly results, the company announced an interim dividend of 10.4p per share. For 2023, the forecasted yield is 3.5%, which is covered two times by the forecasted earnings. Even if, with the macro headwinds, the earnings come under pressure, there is enough margin of safety for investors.

Moving ahead, the company is sitting on a strong order book value of £18 billion, with an additional £10 billion in the second half. With the increased defense budget across different countries, the company has given a bullish outlook and confirmed its full-year guidance numbers for 2022.

Is BAE Systems Stock a Buy?

According to TipRanks’ analyst consensus, BAE stock has a Moderate Buy rating, based on six buy and two Hold recommendations.

With a high forecast of 1,225.9p and a low forecast of 882p, the BAE average target price is 1,006.80p. The average price has an upside potential of 16%.

Prudential PLC

Prudential is an insurance company that provides health and life insurance services to around 19 million customers in Asia and Africa. It also provides asset management and retirement solutions.

The company’s focus on Asian markets can now work in its favor, considering the prevailing economic pressures. These markets could turn around the growth prospects of the company with a larger available market, rising household incomes, and lower competition. The company is targeting to increase its customer base to 50 million by 2025.

Citigroup analyst Andrew Baker, said, “As a pure-play Asia business, Prudential is a lot cleaner story than it has been historically.”

Speaking about its half-yearly results, the company’s new business profits were hit by higher interest rates and fell by 7% to $1,098 million. But, its APE (annual premium equivalent) increased by 9% to $2.2 billion. The APE number was positive in markets like India, Vietnam, Thailand, Taiwan, and Africa. Taiwan saw the highest increase in APE at 55%, driven by higher sales and favorable product changes.

The stock has fallen by 15% YTD, but a Strong Buy rating from analysts and a perfect score of 10 makes it easier to believe that the stock is poised for future growth.

Is Prudential a Buy, Hold, or Sell?

According to TipRanks’ analyst consensus, Prudential stock has a Strong Buy rating with seven Buy recommendations.

The PRU price target is 1,426.0p, which has an upside potential of 28% from the current price level. The price has a high forecast of 1,585p and a low forecast of 1,205p.

Conclusion

Investors are not seeing any signs of macroeconomic headwinds going away from the market. In such a situation, the highly rated stocks as per the TipRanks Smart Score can come to the rescue.