Exiting the stock at the right time is equally important as entering it. In such situations, trusting an analyst’s recommendation is the best thing to do.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

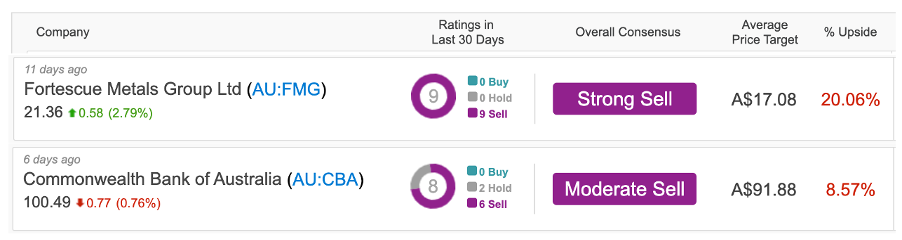

Based on this backdrop, we have shortlisted two ASX stocks: Commonwealth Bank of Australia (AU:CBA) and Fortescue Metals Group (AU:FMG). Analysts are not impressed by these stocks and have given them Sell ratings.

Here, we have used the TipRanks Trending Stocks tool for the Australian market to pick these stocks. This tool comprises a list of stocks that have recently come on the radar of analysts and have been rated by them in the last few days.

Let’s have a look at them in detail.

Commonwealth Bank of Australia (CommBank)

CommBank is among the largest financial services companies in Australia, serving around 16 million customers worldwide.

The bank recently announced its half-yearly results for the fiscal year 2023. Despite posting higher operating income and cash earnings, the stock tumbled on outlook concerns raised. The stock has trended lower by 5.4% in the last three months.

CommBank’s net interest margin grew by 18 basis points to 2.10%, which pushed the net interest income up by 19% in the first half. Analysts feel the higher interest rates for the bank have already reached their peak. The bank also raised concerns over higher cost pressures on households resulting in a spending slowdown.

On the positive side, the stock is still a good investment option for value investors. The bank announced a full-frank dividend of $2.10 per share, an increase of 20% on the dividends for H1 2022.

What is the Future of CBA Share Price?

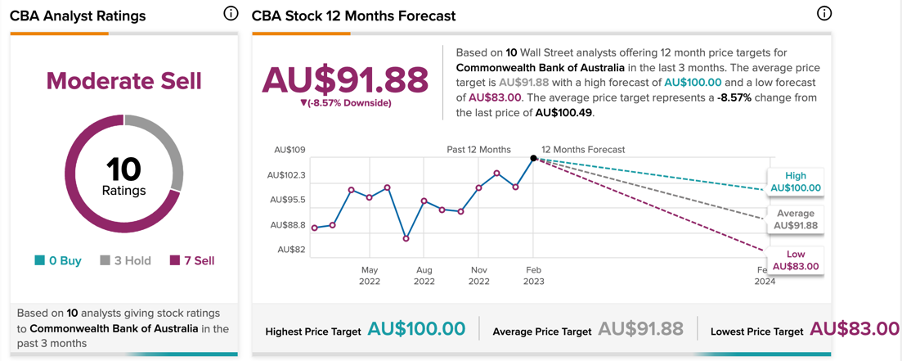

Post-results, one analyst downgraded his rating on CBA, while others reiterated a Sell rating on the stock.

Overall, CBA stock has a Moderate Sell rating based on seven Sell and three Hold recommendations.

The average target price of AU$91.88 is 8.6% lower than the current price level.

Fortescue Metals Group Limited

Fortescue Metals is a leading resources company known for its low-cost production and supply of iron ore.

The company’s stock has gained a whopping 229% over the last three years, driven by higher energy prices. However, the stock remains volatile due to the pullback in commodity prices over the last year.

In February, the company announced its half-yearly results for the period that ended on December 31, 2022. The company’s revenue of $7.8 billion decreased by 4% compared to the previous year’s half-yearly numbers, mainly due to falling iron ore prices. Earnings fell by 9% to $4.4 billion.

Additionally, the company declared 13% lower dividends at AU$0.75 per share compared to AU$0.86 per share in H1 2022. Still, the dividend yield is at a higher level of more than 10% compared to the industry average of 1.87%

The company did achieve some record numbers in iron ore shipments of 96.9 million tonnes during this period. However, this did not impress analysts, who reiterated their Sell rating post-earnings.

FMG Share Price Prediction

FMG stock has a Strong Sell rating on TipRanks. Analysts are bearish on the stock, with 10 Sell recommendations.

The average target price is AU$17.08, which is 20% lower than the current price level.

Conclusion

Both CBA and FMG stocks are expected to decline as analysts don’t see any near-term turnaround in these companies.

On the plus side, these companies remain good dividend payers and could be safer option for value investors.