ASX- listed mining companies Pilbara Minerals Limited (AU:PLS) and Mineral Resources Limited (AU:MIN) will report their second-quarter earnings for the fiscal year 2023 this week.

Pilbara Minerals is currently riding the growth wave of lithium based on the huge demand for cleaner energy solutions. Analysts are expecting the company to continue its trend of higher profits and also begin making dividend payments.

On the other hand, Mineral Resources’ huge stock price growth has made the valuations very high, and investors could wait for the next dip. Analysts expect higher earnings and revenues in the first half of fiscal year 2023.

Here, we have used the TipRanks Earnings Calendar for the Australian market to screen these companies. This tool comprises all the upcoming earnings of the companies that can be filtered by any sector.

Let’s have a closer look at them.

Pilbara Minerals Limited

Pilbara is a leading lithium company that owns and operates the Pilgangoora Project in Australia.

The stock has generated a huge return of 53% in the last year and also touched a record point after the first quarter results for the fiscal year 2023.

The lithium producer will announce its Q2 2023 results on February 24. The consensus EPS forecast is AU$0.42 per share, much higher than the previous year’s EPS of AU$0.04 in the same quarter. The sales forecast for the quarter is AU$2.2 billion, driven by a higher average sales price, which increased by 33% on a quarter-over-quarter basis.

Speaking about the production numbers, the company posted a 10% growth in Q2 as compared to the previous quarter. The cash balance jumped by 62% to AU$2.22 billion. Based on such solid numbers, the company has announced that it will start paying a dividend in the fiscal year 2023 at a target payout ratio of 20-30%.

What is the Future Forecast for Pilbara Minerals?

Macquarie analyst Hayden Bairstow recently reiterated his Buy rating on the stock ahead of its earnings release. His target price of AU$7.5 has a huge upside potential of 75%.

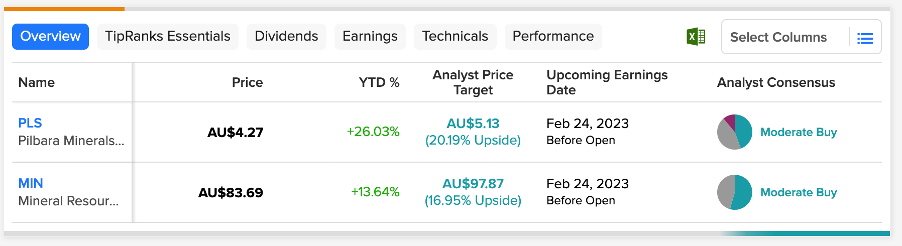

According to TipRanks’ rating consensus, PLS stock has a Moderate Buy rating.

The average target price is AU$5.13, which shows growth of 20% from the current price level.

Mineral Resources Limited

Mineral Resources are a leading producer of iron ore and lithium. The company also provides mining services like on-site operations, maintenance, etc. to other energy companies.

The company will report its half-year financial results for 2023 on February 24. As per the consensus on TipRanks, the forecasted EPS for Q2 is AU$2.4 per share, which is a huge improvement over the negative EPS of AU$0.19 in the same quarter a year ago. The expected sales for the second quarter are AU$2.41 billion.

Even though analysts remain upbeat about the operational performance of the company, they have mixed views on the share price growth. In the last year, the stock has generated a return of 86%, making it an expensive stock to buy.

Moreover, the company’s Mt Marian lithium expansion project has been delayed due to equipment and labor shortages. This has led to reduced guidance numbers for full-year lithium production.

Is Mineral Resources Limited a Good Buy?

On TipRanks, MIN stock has a Moderate Buy rating, based on six Buy and five Hold recommendations.

The average price target is AU$97.87, which shows a change of 17% from the current trading levels.

Conclusion

The growing demand for clean energy has created a huge market for lithium, which has fueled the growth of both of these companies.

Analysts are expecting higher numbers in the upcoming results based on higher production and sales prices. However, the stocks seem somewhat expensive at the moment, considering their huge growth in the last year.