ASX energy stocks have seen a good year in their stock prices, driven by higher oil prices after the Russia-Ukraine war. After reaching new highs in 2022, oil prices began to fall toward the end of the year. The Chinese lockdown extensions impacted oil demand in the second half of 2022, causing prices to fall. The West Texas International (WTI) crude oil price almost touched $120 per barrel in June 2022 and returned to around $75 in December 2022.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Since the beginning of 2023, the oil price has touched as low as $72 per barrel and is currently at $77.98 at the time of writing. The Energy Select Sector SPDR Fund (XLE) is also down by 2.6% in the last five days.

Even though the increased supply of oil has pushed the prices down, analysts feel the oil prices will again touch some high points. RBC expects the average price for WTI to be around $92 per barrel in 2023.

Based on this backdrop, we have shortlisted two ASX stocks from the energy sector using the TipRanks ASX Energy Shares tool. The stocks of Santos Limited (AU:STO) and Woodside Energy Group (AU:WDS) have been on investors’ radars over the last year.

While focusing on any particular sector, the TipRanks comparison tool provides the right way to screen and compare the stocks.

Let’s have a look at these ASX stocks in detail.

Santos Limited

Santos is Australia’s largest domestic gas supplier and has a strong presence in Asia-Pacific.

Santos’s stock has fallen behind its peers, with just a 2.7% return in the last year. The share price has been falling since June 2022, after touching the highest point in three years. Analysts forecast a good upside in the share price in 2023, considering its record sales numbers and a strong balance sheet.

Recently, the company reported its fourth-quarter numbers for 2022. The company posted a 65% jump in its quarterly sales of $1.9 billion. The annual cash flow for the company has more than doubled to $3.6 billion. With such a strong base, the company is confident it will benefit from a further rise in commodity prices.

During the quarter, production numbers were slightly hit due to the temporary shutdown of John Brookes’ platform in Western Australia. The company has also reduced its full-year output from 91-98 million barrels of oil to 89-96 million barrels in 2023.

What is Santos’ Price Target?

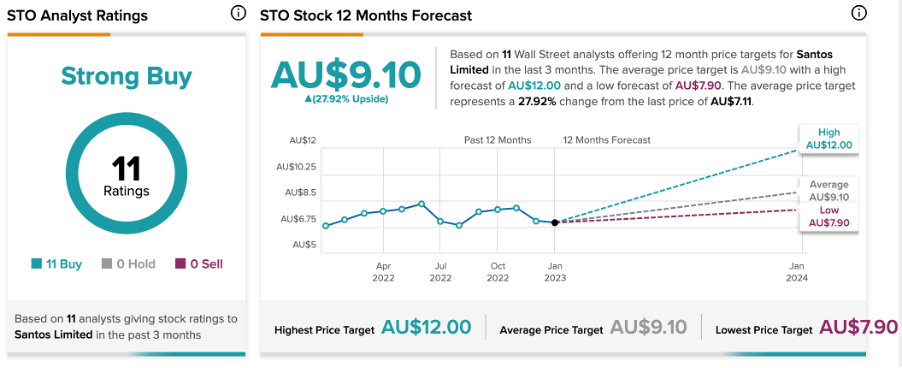

According to TipRanks’ rating consensus, Santos stock is a Strong Buy, based on 11 Buy recommendations.

The Santos target price is AU$9.10, which has an upside of 28% on the current price level.

Woodside Energy Group Limited

Woodside Energy is an energy company engaged in the exploration and production of petroleum. It is among the leading energy companies in hydrocarbon production.

The company’s stock gained a huge 60% in the last year, driven by its merger with BHP’s petroleum business and the higher oil prices.

Last week, the company reported its fourth-quarter report for 2022. The quarterly production was 0.7% lower at 51.6 MMboe (million barrels of oil equivalent). The total delivered sales volume was also down by 8.5% to 52.2 MMboe as compared to the previous quarter. On account of lower crude oil and LNG prices, the revenue was down by 12% to $5.2 billion.

Despite this, the company exceeded its full-year production guidance with a record 157.7 MMboe in 2022. For 2023, Woodside expects production of 180–190 million barrels of oil equivalent.

Analysts remain worried about the higher-than-expected capital expenditure. The wealth management company, Ord Minnett, has recently reiterated its Hold rating on the stock. The broker feels that even though the company’s balance sheet is in a good position, investors should not expect any substantial capital returns on the stock.

What is the Price Prediction for Woodside?

The price prediction for Woodside’s stock is AU$38.07, which shows a slight change of 5%.

Overall, the stock has a Hold rating on TipRanks.

Conclusion

The rising oil price has acted as a tailwind for these energy companies. With further growth expected in oil prices, these companies are positive about boosting their revenues from it.

In terms of share price growth, analysts expect an upside in Santos’ stock. On the other hand, they have a neutral opinion of Woodside’s stock.