Investing in a few ETFs or ETPs could provide better diversification and effective risk management for investors’ portfolios. There are various types of ETFs to balance the portfolio. One such type is a leveraged ETF, which includes borrowing to further increase the return on the investment. These funds track the index of stocks, bonds, commodities, etc., and give the benefit of multiplied returns.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

3x leveraged funds offer three times the returns on the underlying stock’s performance. These funds come with a huge amount of risk but also higher potential gains.

Today, we will discuss three such UK-based ETFs, that are gaining a lot of traction in the market, as evidenced by their higher trading volumes.

Let’s have a look at some of the details.

Leverage Shares 3x Tesla ETP (GB:TSL3)

The Leverage Shares 3x ETP tracks the iSTOXX Leveraged 3x TSLA Index. The ETP has just one holding, Tesla Motors (NASDAQ:TSLA), which has 100% weightage.

The main motive of TSL3 is to generate higher returns, which are three times the daily performance of Tesla’s stock. The ETP directly invests in Tesla’s stock and also uses the additional margin to buy more shares.

In terms of the trading price, the ETP price has jumped by a huge 400% YTD. Tesla’s stock grew by 98% YTD. The average volume of trading over the last three months is 29.5 million shares. The higher the volume, the easier it becomes for daily trading.

The ETP has a higher beta of 4.81, which indicates more volatility, and the expense ratio also remains high at 3.75%. However, many investors still prefer these funds, considering the larger returns.

Overall, TSL3 has a score of seven on the TipRanks Smart Score tool. The analyst consensus is Moderate Buy.

GraniteShares 3x Long Rolls-Royce Daily ETP (GB:3LRR)

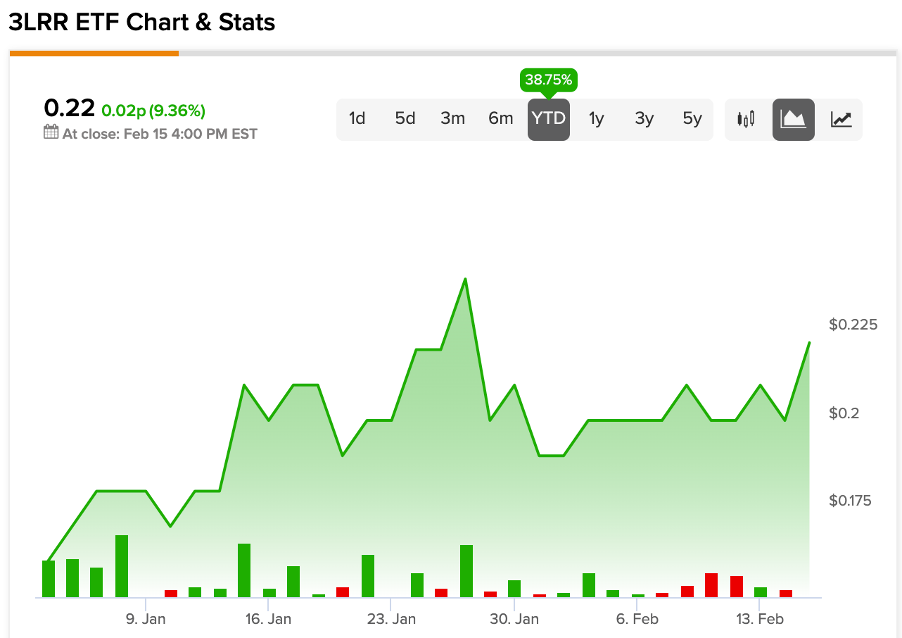

3LRR is a fund that tracks the Solactive Daily Leveraged 3x Long Rolls-Royce Holdings plc Index – GBP. This fund invests in Rolls-Royce Holdings (GB:RR) and provides three returns on the stock’s performance. In the last three months, the average volume of shares traded was 42.1 million.

Being a leveraged 3x fund, the expense ratio for 3LRR is on the higher side at 4.24% and a beta of 3.13. The higher beta implies the fund is more volatile than overall market returns.

According to TipRanks’ technical analysis, the fund has a Buy rating within a time frame of one month.

The trading performance of the fund has been good, with a return of 38.75% YTD.

Graniteshares 3X Short Tesla Daily ETP (GB:3STS)

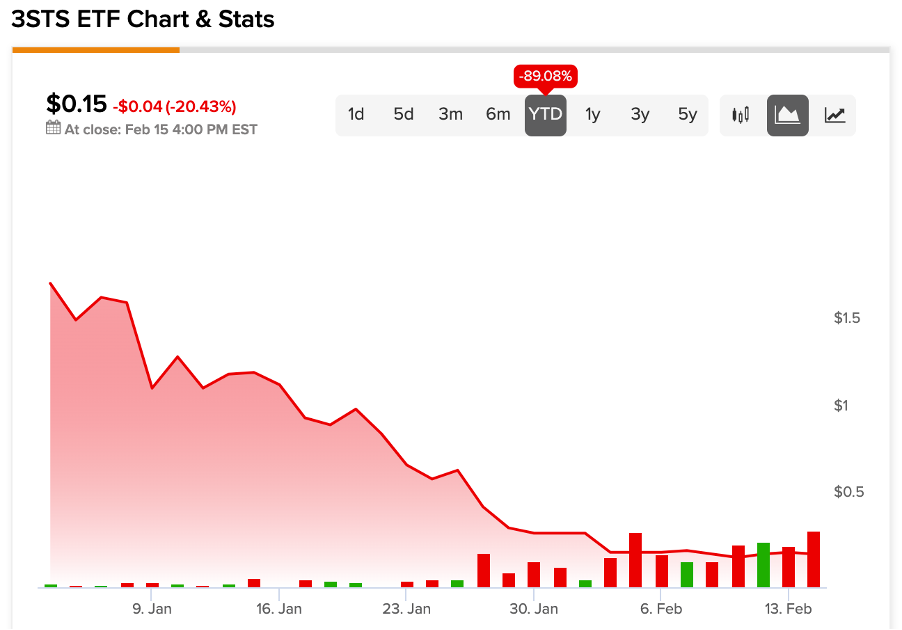

The 3STS fund tracks the Solactive Daily Leveraged 3x Short Tesla Index – Benchmark TR Net. The fund is issued by GraniteShares Inc., which is known for offering innovative ETF solutions for investors. The fund offers 3x returns on the daily performance of Tesla Inc.‘s shares.

In terms of trading volume, 3STS has lower numbers as compared to the other two funds. The average volume for three months is 3.56 million for 3STS.

As compared to 3LRR and TSL3, this fund has a low expense ratio of 0.01%, which makes it more profitable for investors. However, the fund price has been down by 89% YTD, and the technical indicators also suggest a Sell signal.

Conclusion

With great risks often comes great rewards. Even though 3x leveraged funds are a risky affair, they are a preferred choice of investment for many. Among the three above-discussed funds, TSL3 and 3LRR have delivered higher returns this year along with large volumes of trading. On the other hand, 3STS offers a lower expense ratio to investors but is lagging in terms of price growth.