Hong Kong-listed stocks of China-based Tencent Holdings Limited (HK:0700) and NetEase (HK:9999) crashed today after Chinese regulators announced new measures to tighten the grip on excessive spending on video games nationwide. The new regulations came as a big blow to the gaming industry players, considering their prior recovery and robust growth throughout the year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tencent shares plummeted around 12.4% today, wiping billions of dollars from the market. In the third quarter of 2023, the company earned RMB32.7 billion from its domestic gaming segment, reflecting 5% year-over-year growth and constituting more than 20% of its overall revenues.

NetEase, a significant player in the gaming industry and a smaller counterpart to Tencent, witnessed a nearly 25% decline in its stock. NetEase generated around 80% of its total revenue from gaming in the third quarter of FY23.

New Headwinds for the Gaming Industry

As per the new draft guidelines, it is now mandatory for game owners to refrain from endorsing high-value transactions involving virtual entities. The games are also mandated to limit the amount players can deposit into their digital wallets for in-game expenditures. Moreover, a ban on daily login rewards and restrictions on recharging will be enforced, accompanied by pop-up warnings for users demonstrating “irrational consumption behaviour.”

Morningstar analyst Ivan Su stated that the elimination of these incentives is expected to “reduce the daily active users and in-app revenue” of gaming companies.

Is Tencent a Good Stock to Invest In?

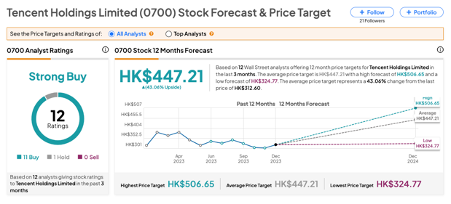

According to TipRanks’ rating consensus, 0700 stock has received a Strong Buy rating, backed by 11 Buys and one Hold recommendation from analysts. The Tencent share price forecast is HK$447.21, which implies an upside of almost 43% on the current trading level.

What is the Target Price for NetEase Stock?

On TipRanks, 9999 stock also carries a Strong Buy consensus rating, backed by all four Buy recommendations. The NetEase share price target of HK$220.50 implies an upside of 36% from the current level.

Year-to-date, the stock has gained over 40% in trading.