In major news on Spanish stocks, Zara’s owner, Industria de Diseño Textil, S.A. or Inditex (ES:ITX), reported in-line profits in its Q1 2024 results despite facing a decline in sales growth. The company’s net profit increased by 10.8% to €1.3 billion in the Fiscal first quarter that ended on April 30, aligning with analysts’ average forecast. In comparison, net profit surged by 54% in the same period a year ago.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the release of the results, Inditex shares gained 4.7% at the time of writing. In the last 12 months, IDX stock has traded up by 44%.

Inditex is a leading Spanish retail company with a global presence in over 200 markets. The company boasts a diverse portfolio of brands, including Zara, Pull & Bear, and Massimo Dutti.

Highlights from Inditex’s Q1 Results

Inditex stated that its Spring/Summer collection has performed well and is ahead of its competitors amid disruptive weather across Europe. It reported sales of €8.15 billion in Q1, surpassing analysts’ average forecast of €8.1 billion in an LSEG (London Stock Exchange Group) poll. This marked a 7% year-over-year increase in sales, reflecting an anticipated slowdown compared to the 13% surge in sales reported in Q1 2023.

Additionally, the company provided an update for the first five weeks of the second quarter, which came as a positive surprise for many. Sales during this period increased by 12% year-over-year, suggesting a better-than-expected second quarter.

RBC analyst Richard Chamberlain anticipates robust demand for the company’s products and predicts 20% sales growth for the remaining second quarter. Chamberlain recently confirmed his Hold rating on the ITX stock, with an upside of 1.7%.

Is Inditex a Good Stock to Buy?

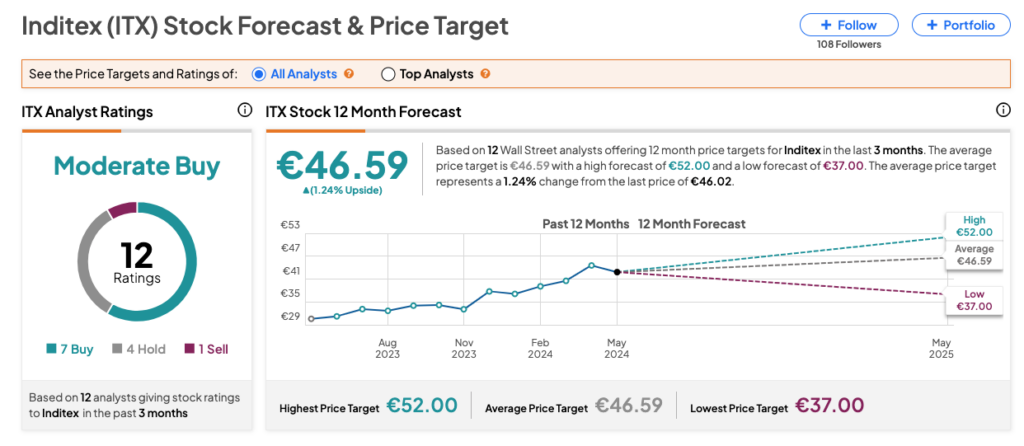

As per the consensus among analysts on TipRanks, ITX stock has been assigned a Moderate Buy rating based on seven Buy, four Hold, and one Sell recommendations. The Inditex share price target is €46.59, which signifies a potential change of 1.24% from the current share price.