Spain-based Banco Santander, S.A. (ES:SAN) raised its revenue growth guidance for 2024 after delivering solid results for the second quarter. The bank’s revenues grew by 10% year-over-year to €15.7 billion. This resulted in a record revenue of €31.05 billion for the first half. Consequently, the bank raised its revenue growth guidance for the full year to high-single digits. It also expects to achieve efficiency of around 42% and RoTE (return on tangible equity) of over 16% in 2024. SAN shares trended higher by 3%.

Here, we have used the TipRanks Earnings Calendar tool for the Spanish market to identify Santander Bank, which has disclosed its results today. The earnings calendar is a useful tool that offers users up-to-date information, helping them stay informed about upcoming earnings releases from various companies. It includes essential details like date, projected EPS, reported EPS, and more.

Highlights from Santander’s Q2 Results

In the second quarter, profit attributable to shareholders increased by 20% year-over-year to €3.2 billion. Meanwhile, pre-tax profits grew by 16% to €5 billion as compared to the same period last year.

The bank’s net interest income increased by 6.9% year-on-year in the second quarter to €11.47 billion. However, this figure was below the €11.96 billion expected by analysts, mainly due to the negative impact of hyperinflation adjustments in Argentina.

In the first half, net interest income grew by 12% to a record figure of €23.46 billion, supported by growth across its multiple segments.

Is Banco Santander Stock a Buy?

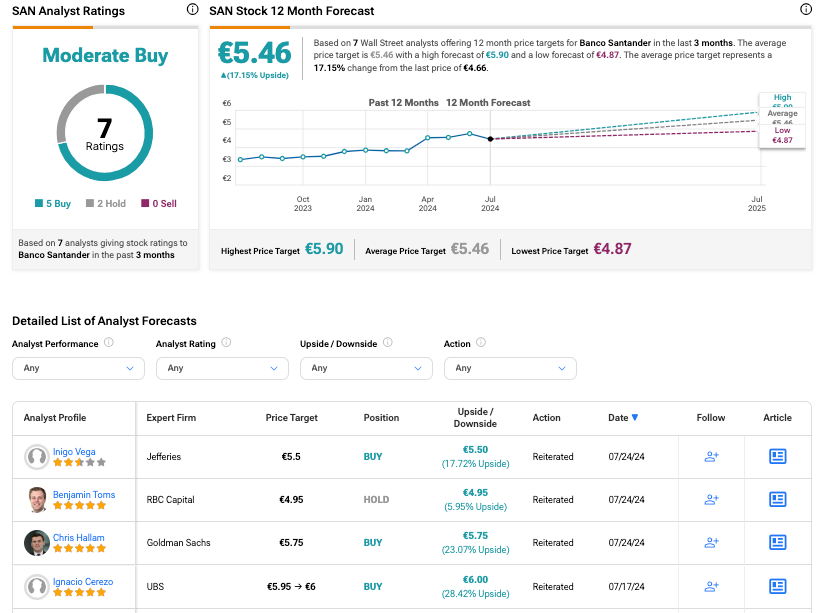

Following the results, SAN stock has received two Buy ratings from analysts at Jefferies and Goldman Sachs. Jefferies analyst Inigo Vega stated that revenue trends, especially in fees, are positive, with strong performances in Spain and the U.S.

According to TipRanks’ analyst consensus, SAN stock has a Moderate Buy rating. The stock has five Buy and two Hold recommendations. The Santander share price forecast is €5.46, which is 17.15% higher than the current price level.