In key news for Singapore stocks, Singapore Telecommunications, also known as Singtel (SG:Z74), reported its results for the third quarter of Fiscal Year 2024. Singtel’s post-tax profits slipped 12.5% year-over-year to S$465 million due to one-time extraordinary charges from its Australian telecom unit Optus and Airtel. Singtel shares declined by 1.3% this morning on the news.

Airtel performed well in India, but its African operations were impacted by currency depreciation. Regarding Optus, Singtel said that the nationwide outage in November led to a one-time charge of S$54 million for the unit. Also, the group faced one-off charges from its Bharti Airtel unit due to the revaluation of foreign currency exchange bonds, taking the total of extraordinary items to S$94 million.

Further Details of Singtel’s Results

Singtel’s Q3 FY24 operating revenues declined 3.2% to S$3.59 billion. This was due to the absence of revenue from its cybersecurity unit, Trustwave.

Even so, the underlying net profit for the three months ending December 31, 2023, remained relatively flat at S$559 million. The company attributed these profits to strong performance from Optus and the information technology (IT) unit National Computer Systems (NCS). NCS posted a 47% year-over-year jump in EBITDA. Meanwhile, Optus saw meaningful growth in the mobile segment.

In contrast, Singtel Singapore continued to face pressure in its home market from macro challenges and weak spending by corporates and consumers, thus reducing its EBITDA by 4.9%. Singtel is also finding difficulty in scaling its Nxera data center business in Singapore due to macro headwinds and additional investments.

For the nine months ending December 31, 2023, Singtel’s net profits soared by 52.9%, while revenues fell 3.2% compared to the same period last year.

Is Singtel a Good Stock to Buy?

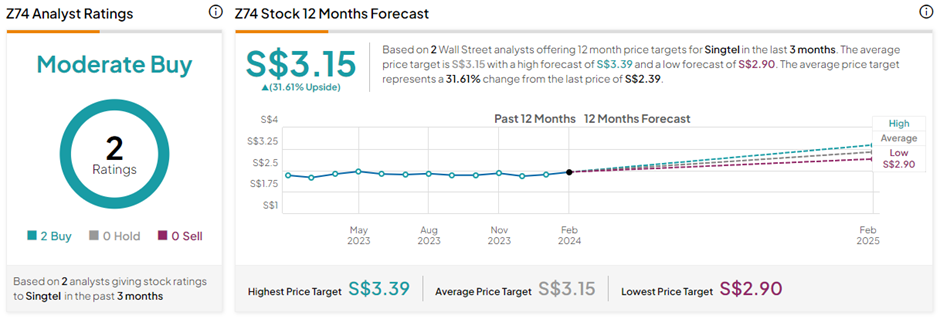

Following the Q3 update, Citi analyst Arthur Pineda reiterated a Buy rating on Singtel shares with a price target of S$2.86 (19.7% upside). On TipRanks, Z74 stock has a Moderate Buy consensus rating based on two Buy ratings received during the past three months. The Singapore Telecommunications Ltd share price forecast of S$3.15 implies 31.6% upside potential from current levels.