German manufacturing companies Siemens (DE:SIE) and Infineon Technologies AG (DE:IFX) will announce their Q1 earnings for the fiscal year 2023 over the next ten days.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

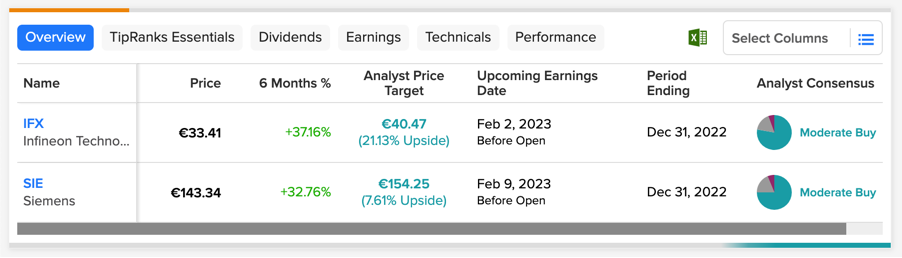

These stocks have a consensus rating of Buy from analysts, who are also optimistic about the share price growth.

For all earnings-related information, the TipRanks Earnings Calendar is a one-stop destination. This tool, which is available for seven different markets, presents a date-wise schedule of the forthcoming earnings of companies. Investors can click on these stocks for any further information, like analysts’ forecasts, earnings, stock analysis, and more.

Let’s have a look at the details.

Infineon Technologies AG

Infineon Technologies is a leading provider of semiconductor solutions to various industries and operates through 20 manufacturing locations globally.

Infineon will report its first quarter results for 2023 on February 2, with a forecasted EPS of €0.56 per share. This is higher than last year’s EPS of €0.41 in the same quarter.

The analysts are expecting the results to be well supported by its automotive segment. The automotive segment contributed 45% to the company’s total revenue in 2022. During this quarter, the expected revenue is around €4 billion, which is higher than the €3.16 billion in the first quarter a year ago.

Analyst Francois Xavier Bouvignies from UBS is highly bullish on the results and expects total revenue of €4.06 billion for the quarter. He expects a good start for the company in 2023, considering its order growth and its grip on pricing. Bouvignies has a Buy rating on the stock at a target price of €44, which represents an upside of 32%.

The analysts are also awaiting the full-year outlook for 2023 in this quarter’s earnings.

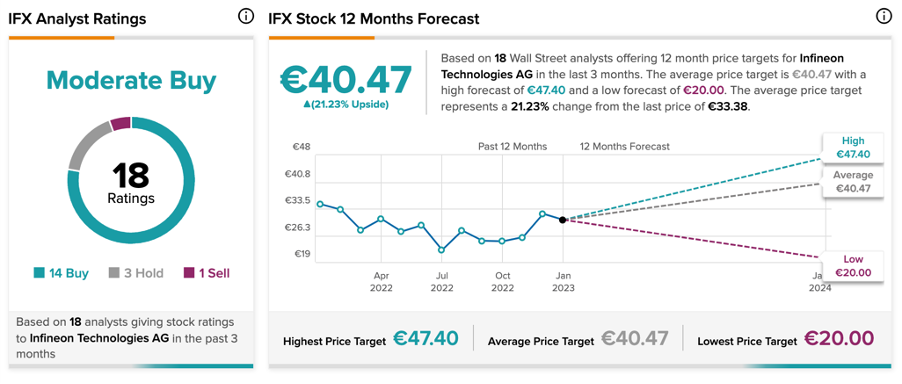

What is the Forecast for Infineon?

The average forecast for Infineon’s share price is €40.47, which has an upside of 21%.

According to TipRanks’ analyst consensus, Infineon’s stock has a Moderate Buy rating, based on a total of 18 recommendations.

Siemens AG

Siemens is a leading manufacturing company in Europe that operates in sectors like aerospace, cement, automotive, healthcare, data centers, transportation and logistics, mining, etc.

Siemens will report its Q1 2023 results on February 9. The EPS forecast for the quarter is €1.95 per share, as compared to the EPS of €2.04 in the Q1 of 2022.

According to the consensus estimates, the company is expecting revenue of €18.1 billion, down from €20.6 billion in the previous quarter. However, the number is 10% higher than in the first quarter of 2022. The expected order value for the company is €20.8 billion, which is also lower than the order value of €21.8 billion in the previous quarter.

In terms of number growth, the company had an outstanding year in 2022. Moving forward, the company expects the supply chain issues to ease. This, along with the solid order backlog, is why Siemens expects its industrial business to drive profits in 2023.

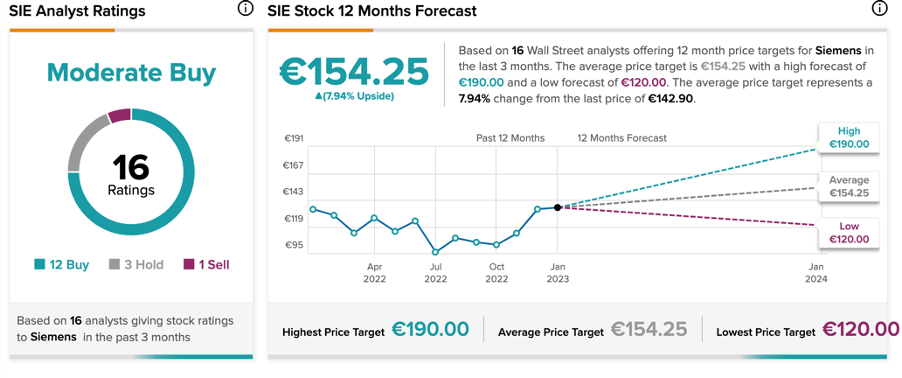

Is Siemens a Buy or Sell?

Siemens’ stock has a Moderate Buy rating on TipRanks, based on a total of 16 recommendations, out of which 12 are Buy.

The SIE target price is €154.25, which is almost 8% higher than the current trading level.

The stock has shown tremendous growth in the last six months and has gained 35%.

Conclusion

Analysts expect a little decline in revenue for Siemens, but they are highly bullish on Infineon’s revenues in the first quarter.

Overall, both companies have received Buy ratings, and investors can hold onto them for better returns.