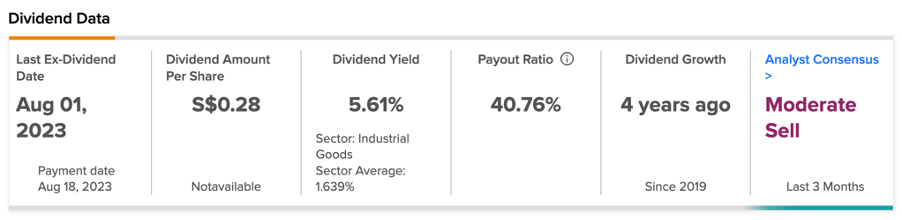

SGX-listed Singapore Airlines Limited (SG:C6L) or SIA provides an opportunity for investors to diversify their income portfolio with higher dividends. SIA boasts a dividend yield of 5.61% that exceeds the industry’s typical rate, making it a favored selection among income-focused investors.

On the flip side, the capital growth story for SIA’s stock doesn’t look promising, with analysts rating it a Moderate Sell.

SIA is a prominent global airline and serves as the flagship carrier of Singapore. The company covers around 107 destinations worldwide, with a strong presence in Asian regions.

SIA Dividend Payout Date 2023

The Singapore Airlines group announced its dividend after a three-year break, coinciding with record-breaking numbers fueled by the resurgence of global travel. The company paid a dividend previously in 2019. The total dividend for FY23 amounted to S$0.38 per share. This was paid in two parts, including an interim dividend of S$0.10 paid in December 2022 and a final dividend of S$0.28 paid in August 2023.

The current dividend yield of the stock is 5.61%, as compared to its industry average of 1.64%.

In its last earnings report published by the company for Q1 2024, the airline reported a record net profit of $734 million, reflecting a growth of 98.4%. “In the future, the company holds a positive outlook regarding passenger demand, supported by robust advance bookings. Nevertheless, the near-term outlook for cargo demand is anticipated to stay subdued due to inflationary pressures and a sluggish economic environment.

What is the Target Price for SIA 2023?

According to TipRanks consensus, C6L stock has received a Moderate Sell rating based on five Sell, three Hold, and one Buy recommendations. The SIA share price target is S$7.31, which indicates an 8.3% growth on the current price level.

The SIA share price witnessed a solid recovery and has gained over 95% in the last three years. This reflected a rebound in air travel demand and a favorable operational landscape. Even though demand remains robust, analysts suggest that favorable factors have already been factored into the price.

Conclusion

SIA’s impressive performance and the payment of a S$0.28 dividend per share boosted investors’ confidence in the stock. Although the potential for share price growth is currently constrained, the dividend narrative remains impressive and could be an ideal fit for income-seeking investors.