DAX40-listed RWE AG (DE:RWE) unveiled a €55 billion investment in global renewable projects, getting thumbs up from several analysts. The investments will be part of its revised strategy, which was announced on its Capital Markets Day on Tuesday. As part of this, the company aims to enhance its green portfolio to surpass 65GW by the year 2030.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

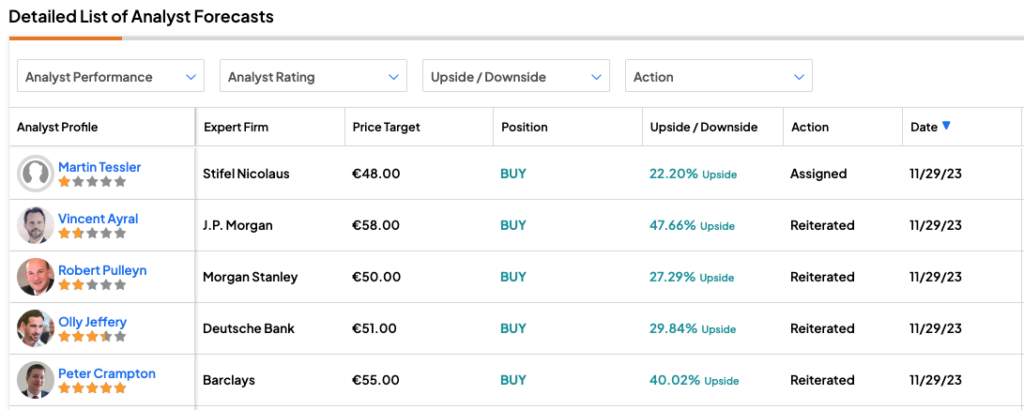

Following the news announcement, various analysts confirmed their Buy ratings on the stock, predicting more growth potential in the share price. Analyst Martin Tessler from Stifel Nicolaus assigned a Buy rating to the stock yesterday at a forecast of over 20% growth.

Analysts from J.P. Morgan, Morgan Stanley, Deutsch Bank, and Barclays have also maintained their Buy ratings on the stock. Among these, J.P. Morgan’s analyst Vincent Ayral has the highest price target of €58.0 on the stock, predicting an upside of around 48%.

Overall, analysts hold a bullish stance on the company’s prospects and share price growth. RWE remains an attractive choice for long-term investment, supported by its solid financial position and the expected generation of robust cash flows. These financial strengths are poised to underpin the expansion of its renewable energy portfolio.

RWE is a German multinational energy company with operations in various regions, including Europe, Asia-Pacific, and the U.S. With a strong foothold in the renewable energy industry, the company is dedicated to achieving carbon neutrality by the year 2040.

“Growing Green” Investment

RWE AG has revised its “Growing Green” investment program, originally initiated two years ago. RWE plans to allocate 40% of its targeted €55 billion net investment towards the expansion of onshore wind and solar activities. The onshore wind sector’s installed capacity is set to increase from the current 8.6 GW to 14 GW by 2030, while solar capacity will expand from 3.9 GW to 16 GW during the same period.

The company also highlighted that 25% of the investment will be allocated to projects related to batteries, flexible generation, and hydrogen. It aims to boost battery capacity from 0.5 GW to 6 GW by the year 2030. This underlines the company’s commitment to advancing technologies crucial for a sustainable energy future.

Among regions, over half of the investment has been designated for projects in Europe. Specifically, in Germany, the company has plans to invest €11 billion from 2024 to 2030. In addition, it outlined plans to invest €8 billion in the UK and around €20 billion in the U.S.

In financial terms, green investments are anticipated to generate an average annual growth of 14%, or €9 billion, in adjusted EBITDA by 2030. The adjusted net income is also projected to experience substantial growth, averaging 12% annually and reaching €3 billion by 2030.

What is the Stock Price Forecast for RWE?

According to TipRanks, RWE stock has a Strong Buy rating, based on unanimous Buy recommendations from 16 analysts. The RWE share price target is €50.40, which is 28% above the current trading level.