DAX-40-listed Rheinmetall AG’s (DE:RHM) share price gained around 4% after the company set an ambitious revenue target of €13-14 billion by 2026. The company announced its newly set sales and profitability targets during its Capital Markets Day 2023 earlier today. These targets exceeded expectations and are mainly driven by higher demand for military products globally. The company further stated that it expects its operating margins to reach over 15% by 2026.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

At the time of writing today, the Rheinmetall share price had gained 4.3% in trading. In 2023, the stock has experienced impressive growth of around 50% year-to-date.

Rheinmetall is a leading manufacturer and supplier of systems and equipment across diverse industries, including automotive, security, and civil sectors. The company has operations in 33 countries worldwide.

Recent Ratings

Earlier this month, the company released its Q3 2023 earnings report, with double-digit sales and income growth. Consolidated sales increased by 13% to €4.6 billion in the first three quarters on a year-over-year basis. Meanwhile, the company’s order backlog experienced significant expansion, rising by approximately 42% to €36.5 billion as of September 30, 2023.

Driven by strong numbers, many analysts reiterated their Buy rating for the stock. Analysts hold optimistic views on the company’s long-term outlook, given its strategic position as a key military supplier, not just for Germany but also for its allied nations.

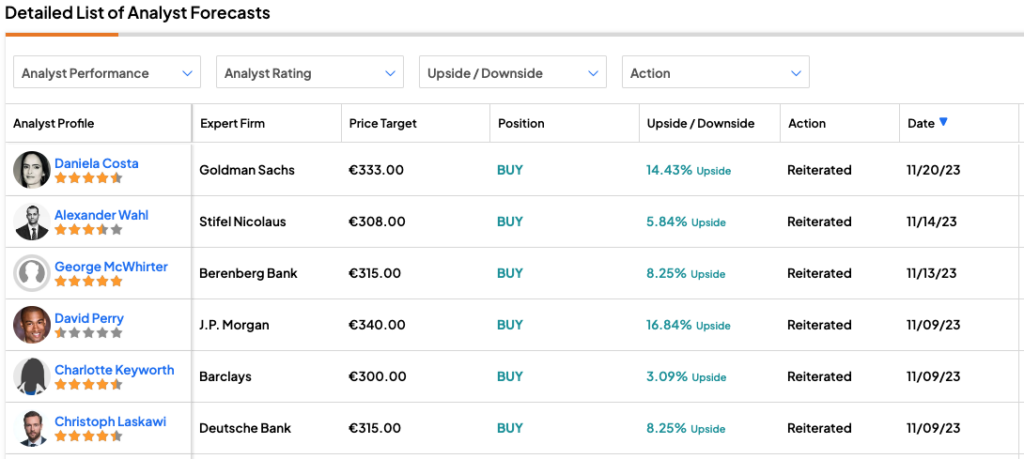

Yesterday, analyst Daniela Costa from Goldman Sachs confirmed her Buy rating on the stock, predicting growth of 14.4%. Prior to this, analysts at Berenberg Bank, UBS, J.P. Morgan, Barclays, and others also recommended buying the stock.

Is Rheinmetall a Good Stock to Buy?

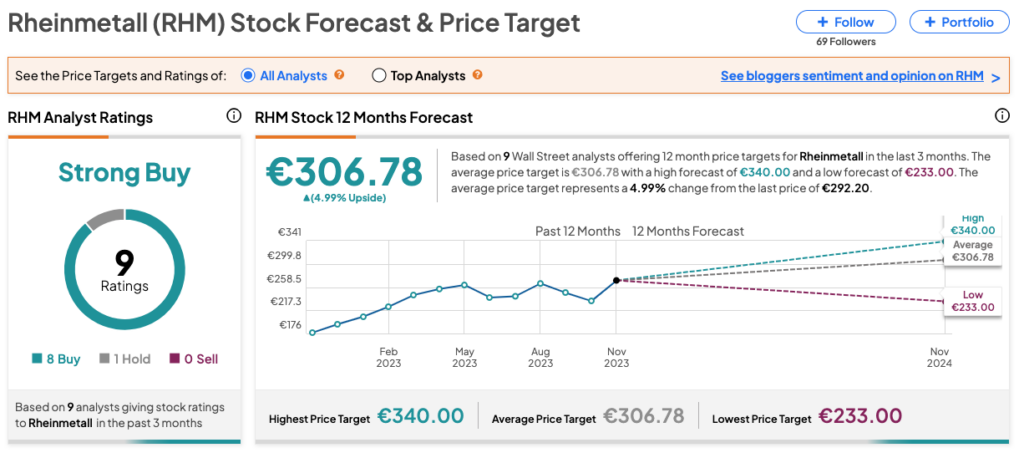

On TipRanks, RHM stock has a Strong Buy rating backed by eight Buy and one Hold recommendations.

The Rheinmetall share price forecast is €306.78, which is around 5% above the current trading level. The target price has a high forecast of €340 and a low forecast of €233.