Spanish companies Red Electrica Corporacion (ES:RED) and Acerinox (ES:ACX) have higher dividend yields, which makes them apt for income investors. In addition, these stocks offer a decent upside to their share prices, according to analysts.

For screening such stocks, we can use the TipRanks Top Dividend Stocks tool, which is available for users in seven different markets.

Let’s have a look at these companies in detail.

Acerinox SA

Acerinox is a steel manufacturing company based in Spain with a huge network of sales across the world. The company generates around 50% of its revenues from North America.

The company declared an annual dividend of €0.60 per share for 2022, which indicated a 20% increase from the previous year. In January, the company paid its interim dividend of €0.24 per share, and the remainder will be paid in July 2023.

During 2022, the company was able to reduce its net financial debt by €138 million along with good cash generation. The operating cash flow in 2022 was €544 million. This has helped the company maintain its dividends, along with two share buyback programs worth €206 million.

Acerinox Share Price Forecast

According to TipRanks’ analyst consensus, ACX stock has a Moderate Buy rating based on two Buy and one Hold recommendations.

The average price target is €12.37, which shows a growth of 31.2% from the current price level.

Red Electrica Corporacion SA

Red Electrica is a utility company in Spain that owns the national electricity grid.

The company currently has a dividend yield of 3.93%, as compared to the industry average of 1.64%. The stock is famous among investors for paying stable dividends over the last few years.

Analysts like the fact that the company’s dividends are covered by growing profits and cash flow, which makes it more feasible. The last dividends paid by the company was €0.22 per share paid in January 2023. The next dividend of €0.59 per share is due in July 2023.

Red Electrica Share Forecast

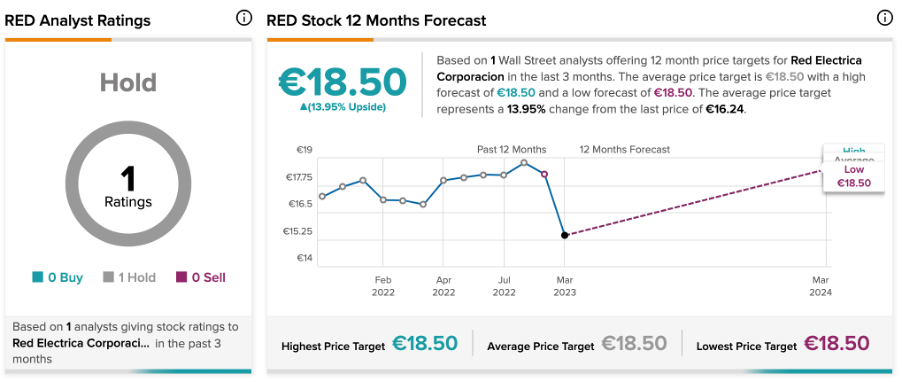

RED stock one Hold recommendation on TipRanks from analyst Fernando Garcia from RBC Capital.

He has a price target of €18.5 on the stock, which implies an upside of 14% on the current price.

Conclusion

Despite the current slowdown in the stock markets globally, dividend-paying companies are a sight of relief for investors.

For such investors, RED and ASX are good options from the Spanish markets to build their dividend portfolios.

Questions or Comments about the article? Write to editor@tipranks.com