Using the TipRanks Daily Analyst Rating tool, we have identified three stocks from the Singapore market: PropNex Limited (SG:OYY), Mapletree Industrial Trust (SG:ME8U), and Singtel (SG:Z74). These stocks have recently been awarded Buy ratings. Analysts affirm that these stocks not only carry Buy ratings but also boast a potential upside of over 15% in their share prices.

Let’s take a look at these shares in detail.

PropNex Share Price Target

PropNex is a prominent real estate brokerage and consulting company that provides a comprehensive online real estate platform that showcases a vast array of residential and commercial properties.

Two days ago, Adrian Loh from UOB Kay Hian confirmed his Buy rating on the stock, implying a growth of 8.4% in the share price. He raised his price target from S$1.07 to S$1.16. He is bullish regarding the company’s planned expansion into the commercial property segment, which will enhance its existing stronghold in the residential market.

According to TipRanks, OYY stock holds a Moderate Buy rating, which is based on two Buy recommendations and one Hold recommendation. The average price target of S$1.50 indicates a potential increase of 40.2% from the current share price.

Is Mapletree Industrial Trust a Good Buy?

Mapletree Industrial Trust, or MIT, is a Singapore-based real estate investment trust. The company possesses a diverse portfolio of assets primarily dedicated to industrial purposes.

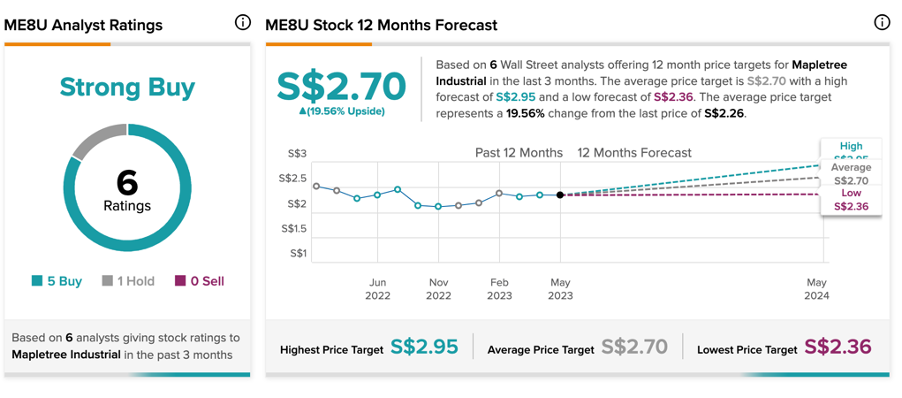

According to TipRanks, ME8U stock has a Strong Buy rating based on a total of six recommendations, of which five are Buy. The average price forecast is S$2.70, which has an upside of 19.5% on the current price level.

Two days ago, Derek Chang from Morgan Stanley reiterated his Buy rating on the stock. He has a price target of S$2.95 on the stock, which is 31% higher than the current price level. On the same day, Brandon Lee from Citigroup confirmed his Hold rating on the stock with a modest upside growth of 4.42%.

Singtel Share Price Target

Singapore Telecommunications Limited, or SingTel, is a leading telecommunications service provider in Singapore that provides mobile, fixed line, internet, TV, cloud solutions, cybersecurity, and various other offerings.

According to TipRanks, Z74 stock is assigned a Strong Buy rating, with all eight recommendations being Buy. The average price forecast of S$3.09 indicates a growth potential of 24% in the share price.

Paul Chew, an analyst from Phillip Securities, upheld his Buy rating on the stock two days ago, projecting a 13.6% increase in the share price.