The share price of the FTSE 100-listed Ocado Group (GB:OCDO) soared after the company signed a robot tech deal with McKesson Corporation’s (NYSE:MCK) subsidiary in Canada. Ocado announced that its Intelligent Automation division will provide its technology to a distribution site owned by McKesson Canada.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

According to the terms of the deal, Ocado will receive upfront fees during the construction process, with the final payment upon the completion of installation. Additionally, the company will be entitled to an ongoing annual fee tied to the servicing and maintenance of the technology. The company expects the financial benefits of the deal to be reflected in its cash flow and earnings in 2025.

This is Ocado’s first deal for warehouse fulfillment technology to cater to clients beyond the grocery retail sector. The company will also supply the essential AI-powered software applications required for the long-term operation of that technology. Ocado’s CEO, Tim Steiner, commented on the deal as a “new and exciting milestone.” He added that after gaining extensive experience in the supply chain and online retail sectors, the company is now extending its expertise and intellectual property to additional sectors.

Ocado Group is a technology-driven company recognized globally for its expertise in software and robotics platforms. It provides comprehensive end-to-end solutions for online grocery services.

The Share Price Volatility

The deal brought some relief to the otherwise struggling share price. After the deal announcement, the shares gained around 5.5% on Wednesday.

The share price, which crossed a high point of 950p in July, has experienced a significant decline since then. In the last three months, the stock has lost over 25% in trading. Ocado Group’s stock witnessed a big surge during the lockdown, reaching a record level surpassing 2,800p in 2021. Nevertheless, by June 2023, the price had decreased to around 300p.

This was mainly attributed to the slowdown in its retail revenues in its key market, the UK. Moreover, the diverse perspectives of analysts contribute to ambiguity, posing challenges for investors in accurately assessing the true value of the stock.

What is the Price Target for Ocado Stock?

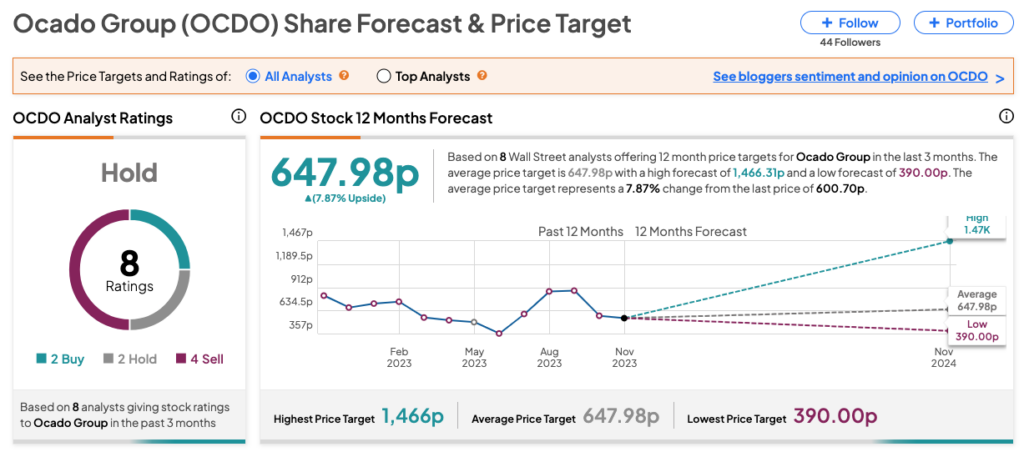

According to TipRanks’ analyst consensus, OCDO stock has received a Hold rating. The stock has four Sell, two Hold, and two Buy recommendations from analysts. The Ocado share price forecast is 648p, which is 7.8% above the current price level.