Shares of Australian furniture retailer Nick Scali (AU:NCK) surged over 19.5% to mark a new 52-week high of AU$14.37 today despite reporting lower revenue and profits for the first half of Fiscal 2024. Revenue dropped 20.2% to AU$226.6 million, while net profit after tax (NPAT) fell 29% to AU$43 million. However, investors cheered the results, as NPAT was better than the company’s guidance of AU$40 to AU$42 million, driven by an impressive gross margin.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nick Scali Limited is an Australian company that imports and retails furniture across the nation. NCK shares have gained over 35% in the past year.

Factors Contributing to NCK’s Share Price Spike

Despite the falling revenues, Nick Scali was able to rev up the gross margin by 360 basis points to hit 65.6% in the six months ending December 31, 2023. Plus, the company maintained its fully-franked (dividend on which tax is paid by the company) interim dividend of AU$0.35 per share, thanks to higher-than-expected NPAT.

Furthermore, shareholders were impressed by the solid order book figures. For the first half of FY24, written sales orders rose 1.1% to AU$212.7 million, boosted by an 8.2% year-over-year jump in the metric in Q2 FY24. What’s more, Nick Scali said that the momentum in the order book continued into January, with written sales orders growing 3.6% year-over-year on a reported basis and 2.6% on a like-for-like basis.

Coming to retail store footprint, Nick Scali opened two new Plush outlets during the period. Moreover, the retailer opened a larger Nick Scali brand store in Payneham, South Australia, and transformed the older one into a clearance centre. This resulted in Nick Scali brand stores remaining at the 64 net store count for 2023 across Australia and New Zealand. The company ended H1 FY24 with 44 Plush stores. Over the long term, the company aims to operate 86 Nick Scali stores and 90 to 100 Plush stores.

Is Nick Scali Stock a Buy, Sell, or Hold?

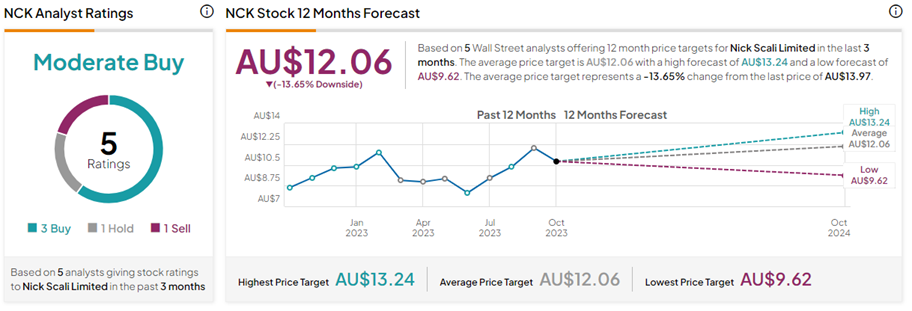

On TipRanks, NCK stock has a Moderate Buy consensus rating based on three Buys, one Hold, and one Sell rating. The Nick Scali share price target of AU$12.06 implies 13.7% downside potential from current levels. Most of these ratings were given before the results and could change based on analysts’ opinions about NCK’s performance.