Shares of French tire maker Compagnie Generale des Etablissements Michelin (FR:ML) rallied nearly 7% on Tuesday after the company reported solid profits for 2023 and announced a share buyback plan of up to €1 billion over the 2024 to 2026 period. Michelin also intends to propose a dividend of €1.35 per share at the company’s upcoming annual meeting. The proposed dividend marks an 8% increase over 2022.

Michelin stock touched a 52-week high of €33.36 yesterday. Shares have advanced about 12% in the past year.

Michelin’s 2023 Results and Outlook

Michelin said that the segment operating income, its key profit metric, increased 5.1% to €3.57 billion in 2023, with the segment operating margin increasing 70 basis points to 12.6%. Analysts expected segment operating income of €3.42 billion.

Moreover, a reduction in working capital requirements and improved EBITDA (earnings before interest, tax, depreciation, and amortization) helped the company generate free cash flow (before acquisitions) of €3.0 billion, marking a major improvement from the negative free cash flow of €104 million in 2022.

Michelin delivered resilient results despite a high-interest rate backdrop and destocking by distributors and professional customers. The company’s 2023 performance gained from higher prices and a favorable product mix.

Coming to the outlook for 2024, Michelin expects segment operating income of above €3.5 billion at constant exchange rates and free cash flow (before acquisitions) of over €1.5 billion. Results for the first quarter of 2024 might be impacted marginally by logistics issues resulting from the Red Sea crisis. Fortunately, only 4% of the company’s shipments are routed through the Suez Canal, as the company mainly relies on African and South American suppliers.

Is Michelin Stock a Good Investment?

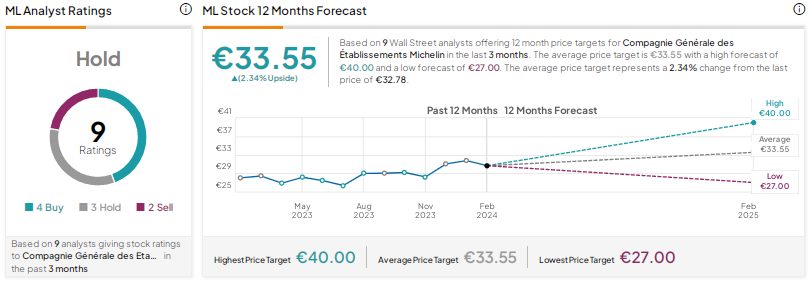

Following the results, UBS analyst David Lesne reiterated a Buy rating on Michelin stock with a price target of €37. The analyst thinks that the company’s 2024 outlook is conservative, leaving the scope for upward revisions.

Overall, analysts are sidelined on ML stock, with a Hold consensus rating based on 4 Buys, 3 Holds, and two Sells. The Compagnie Generale des Etablissements Michelin share price target of €33.55 implies a modest upside potential of 2.3%.