SGX-listed Mapletree Logistics Trust (SG:M44U) disappointed investors with lacklustre results for the third quarter ending December 31, 2023, and a blurry outlook. Despite a tough backdrop in Q3 FY23/24, its Distribution per unit (DPU) grew 1.2% year-over-year to 2.253 cents, backed by a robust portfolio, favorable acquisition contributions, and divestiture gains. Following the news, M44U shares are down 4.9% as of the last check.

Mapletree Logistics Trust or MLT is a real estate investment trust with an operational focus in Asia. MLT acquires and develops logistics and distribution warehouses for single-user and multi-user tenants. Its primary revenue driver is rental income. M44U shares have lost over 8% in the past year.

Details about MLT’s Q3 Performance

In Q3 FY23/24, gross revenue jumped 2.1% to S$184.02 million, while net property income (NPI) grew only 1.5% in the same period, marred by higher property expenses. MLT attributed the revenue growth to higher contributions from existing properties in Singapore and new properties in Japan, South Korea, and Australia. At the same time, the growth was offset by weak contributions from properties in China, a lack of revenue from properties sold, and weak forex rates.

MLT is focusing on modernizing its portfolio of assets to state-of-the-art logistics warehouses. As part of this goal, MLT has sold S$200 million worth of assets year-to-date to free up capital. Moreover, portfolio occupancy was maintained at a healthy 95.9% and weighted average lease expiry stood at 2.9 years.

Looking ahead, MLT expects economic headwinds to persist. Higher interest rates, slow economic recovery, and geopolitical tensions are expected to continue to impact its performance for some time. Importantly, the Chinese leasing environment could remain challenging, especially the negative rental reversion rates.

Is Mapletree Logistics Trust a Good Buy?

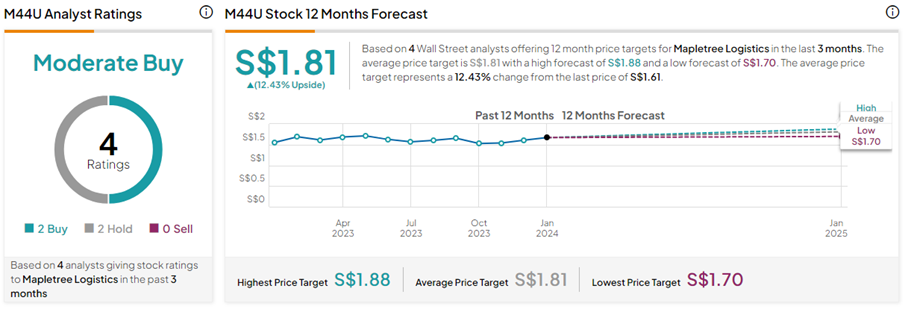

With two Buys versus two Hold ratings, M44U stock has a Moderate Buy consensus rating. The Mapletree Logistics Trust share price target of S$1.81 implies 12.4% upside potential from current levels.