British packaging company Mondi plc (GB:MNDI) is contemplating buying smaller rival DS Smith plc (GB:SMDS) to form a €10 billion packaging giant. Talks are in the initial stages, and Mondi has until March 7 to offer a formal bid or give up the idea, as per U.K. takeover rules. MNDI shares fell 4.7% on the news yesterday, while SMDS stock jumped over 16%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Mondi is a multinational paper, plastic, and flexible packaging company operating across Europe, North America, and South Africa. Meanwhile, DS Smith is a relatively smaller player focusing on paper packaging solutions. Both companies are part of the FTSE 100 index.

Here’s Why Mondi Intends to Acquire DS Smith

Mondi believes that the company can become a leading “European paper-based sustainable packaging solutions” provider by combining with DS Smith. Mondi has shown only a very “preliminary expression of interest” in undertaking an all-stock deal to buy DS Smith.

The global paper packaging industry has witnessed a steep slowdown in sales as customers engage in destocking. The underlying demand for packaged goods has declined from the peak levels seen during the pandemic when e-commerce boosted the demand for packaging. Both volumes and prices for paper packaging firms have fallen considerably following the pandemic.

This is the second merger attempt in the European packaging industry. Rival Smurfit Kappa (GB:SKG) is expected to close its much-awaited $11 billion takeover of American rival WestRock (NYSE:WRK) in July this year.

Is Mondi a Good Share to Buy?

Analysts are optimistic about the potential acquisition. Barclays analyst Pallav Mittal thinks that consolidation in the packaging industry is “inevitable” as it is highly fragmented. Mondi exited the Russian market last year, selling three plants for roughly 82 billion roubles. Mittal says that Mondi needs to put out a strategic vision, given the Russia exit and the expected acquisition bid for DS Smith.

Mittal has a Sell rating on Mondi with a price target of 1,320p (1.2% downside).

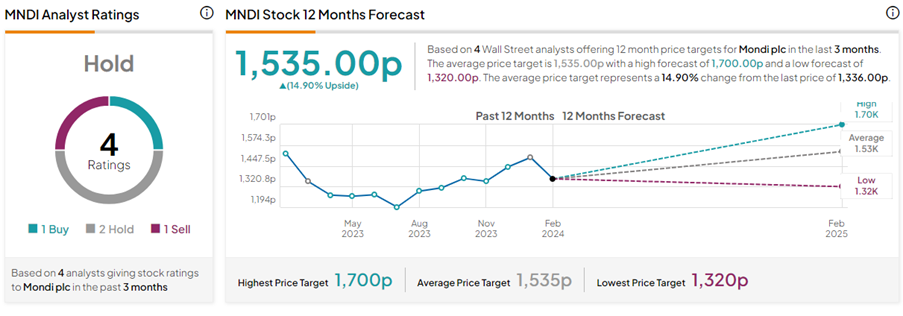

With one Buy, two Holds, and one Sell rating, MNDI stock has a Hold consensus rating on TipRanks. The Mondi plc share price target of 1,535p implies 14.9% upside potential from current levels.

Are DS Smith Shares a Good Buy?

With four Buys and one hold rating, SMDS stock commands a Strong Buy consensus rating on TipRanks. The DS Smith plc share price target of 352.25p implies 14.1% upside potential from current levels.