Credit Agricole S.A. (FR:ACA) announced the acquisition of a 7% minority stake in France-based digital payment company Worldline S.A. (FR:WLN). This investment further enhances the partnership between the two companies, with the aim to support Wordline in becoming a major player in the French merchant payment services market. The deal is expected to provide stability to Worldline’s struggling share price.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

With this deal, Credit Agricole intends to maintain its status as a long-term minority shareholder in Worldline. Following the announcement, Worldline shares experienced a 5% increase during early trading hours yesterday, concluding the day with a gain of 0.65%. Credit Agricole stock ended 0.53% higher.

Credit Agricole is among the leading financial institutions in France. Meanwhile, Worldline offers payment and transactional solutions to customers across multiple industries worldwide.

The Deal’s Backdrop

Both companies signed a binding agreement in July 2023 to help Worldline establish a prominent presence in the French merchant payment services market. Through this transaction, Crédit Agricole reiterates its confidence in its partner and its commitment to support Worldline’s growth in Europe.

The anticipated impact of the transaction on the CET1 (Common Equity Tier 1) ratio of Credit Agricole is projected to be less than 10 basis points.

Credit Agricole added that the preparatory work for the creation of a previously announced joint venture between the two companies is on track, with an operational launch planned this year following regulatory approvals.

Worldline Share Price Gets a Lifeline

In 2023, the Worldline share price experienced a significant decline, losing 60% of its value. The stock saw a dramatic 50% drop on a single day in October 2023 after the company downgraded its full-year targets, attributing the change to the effects of an economic slowdown in key markets. Consequently, the company was actively seeking an investor to lend crucial support to its share price.

Last week, Reuters reported that Worldline was exploring options to address investors’ concerns and avoid a hostile takeover amid the falling share price.

Worldline Share Price Forecast

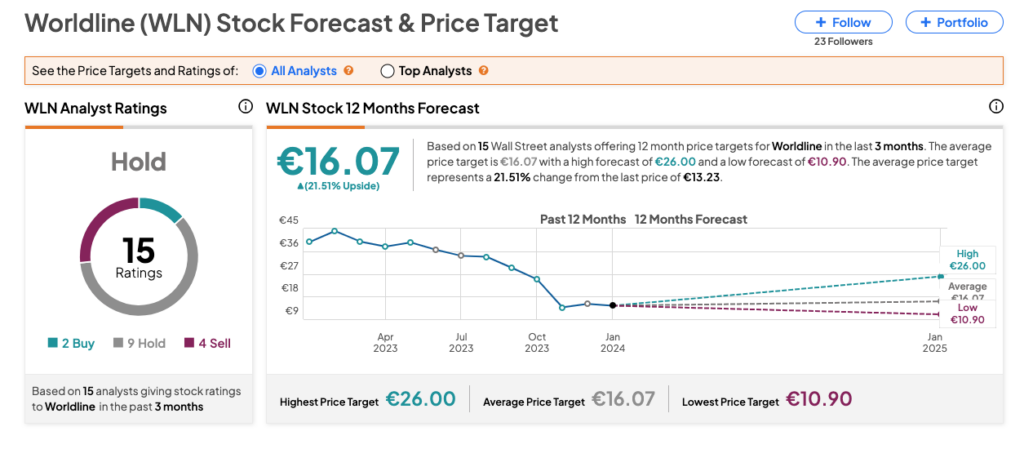

According to TipRanks consensus, WLN stock has a Hold rating based on nine Hold, four Sell, and two Buy recommendations. The average share price forecast is €16.07, which is 21.5% higher than the current trading level.