According to the Bank of Spain, the Spanish economy is expected to slow down by 1.4% in 2023. However, the growth will gain some momentum by the middle of 2024, with an expected growth of 3%. This shows that the economy will bounce back and that these are just short-term hiccups. It is critical for investors not to lose hope during this period and to keep a long-term perspective.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Using the TipRanks Stock Screener tool, we have shortlisted Unicaja Banco SA (ES:UNI) and Banco de Sabadell (ES:SAB). The share market volatility is putting a dent in the earnings of these banks, but the higher interest rates are offsetting that effect by pushing top-line growth.

Unicaja Banco SA

Unicaja Banco provides banking, asset management, insurance, and securities services to its four million customers in Spain. In terms of assets, it is the fifth largest bank in Spain.

Unicaja’s stock was no exception to the rising interest rate environment that favored banks globally. In the last six months, the bank’s stock price has increased by 26%.

The bank’s positive results also supported the share price. For the first nine months of 2022, net income increased by 67.1% to €260 million. This was driven by good retail business and a jump in recurring income. The fee income, which increased by 11% on a year-over-year basis, was mainly supported by its growth in mutual funds and credit cards.

Speaking of the valuation, Unicaja is better placed compared to its competitors. The bank has a P/E ratio of 1.4, against the average of 5.96 for the top 5 banks in Spain.

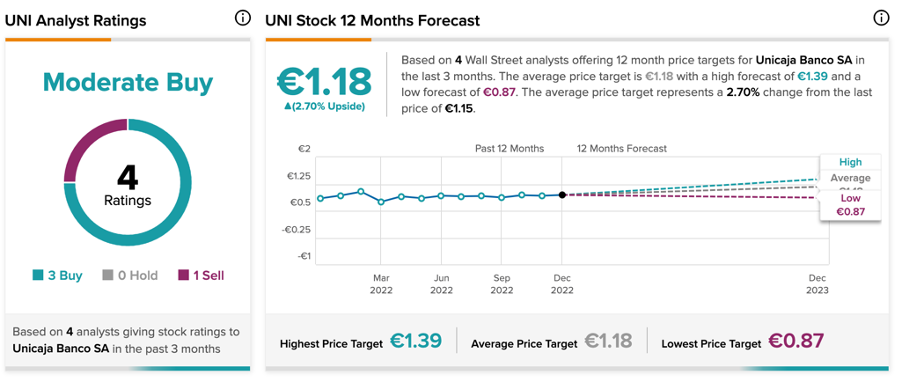

Unicaja Stock Price Target

According to TipRanks’ rating consensus, UNI stock has a Moderate Buy rating.

The average target price is €1.18, which shows a 2.7% increase on the current price level.

Banco de Sabadell SA

Banco de Sabadell is among the top five financial institutions in Spain, engaged in personal and business banking, investments, mortgages, insurance, and more.

The bank’s stock has rewarded its shareholders with a return of 55% in the last year. Due to outperformance, analysts feel there is limited upside potential in the future.

The company posted its third-quarter numbers with stable growth, meeting all its targets. For the first nine months of 2022, the bank made a net profit of €709 million, as compared to €370 million for the same period in 2021. This was well supported by its core revenue (including fees, interest income, and commission), which increased by 5.7% to €3.8 billion. The bank has a strong hold on its lending business, in which volumes increased by almost 3%, driven by all regions. In its third quarter, corporate lending grew by 6%, and new consumer loans were 18% higher than in the third quarter of 2021.

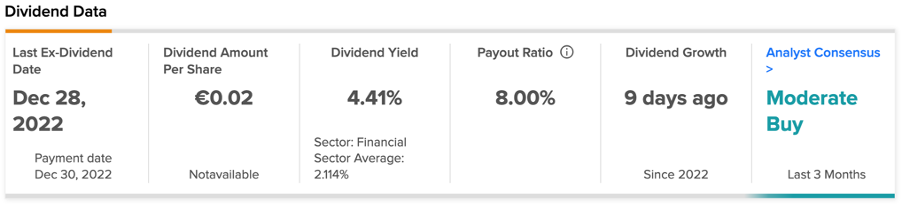

The management approved a payout ratio of 40% for its shareholders and an interim dividend of €0.02 per share. The bank currently has a dividend yield of 4.41%, while the sector average is 2.1%.

Banco Sabadell Stock Price Forecast

According to TipRanks, Sabadell stock has a Moderate Buy rating, based on four Buy and four Hold recommendations.

The average price forecast is €1.04, which is almost 10% higher than the current price level.

Conclusion

Both of these banks are among the top financial institutions in Spain and are doing fairly well, as depicted in their recent results. According to analysts, the share prices have only a little scope for growth as they are already outperforming.

However, these banks have consistent revenues and earnings, so they could prove to be a good addition for investors looking for stability.