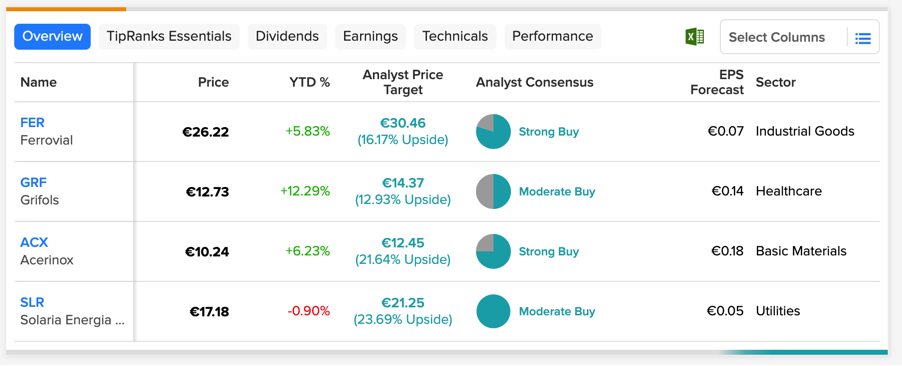

Using the TipRanks Earnings Calendar tool for the Spanish market, we have shortlisted four companies that will report their 2022 earnings tomorrow. These companies have Buy ratings from analysts ahead of their earnings. Moreover, analysts also forecast a decent upside in their stock prices.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Here we have also used the Stock Comparison tool, which comes in handy to compare these stocks on various parameters such as target price, analyst consensus, forecasted EPS, and many more.

Let’s have a look at more details on these Spanish stocks.

Ferrovial SA

Ferrovial is an engineering company that is involved in the construction and management of transport assets in about 15 countries worldwide. The company’s business segments include highways, airports, infrastructure projects, and more.

The company will release its 2022 financial results on February 28, with a forecasted EPS of €0.07 for the fourth quarter. In the previous year, the EPS was €1.77 during the same quarter.

In 2022, the company saw a strong recovery in the airport segment as well as revenue growth in toll roads across the U.S. The company posted revenue of €5.4 billion in the first nine months of 2022, as compared to €4.9 billion in 2021. For the fourth quarter, the forecasted sales are €2.05 billion. For the full year, adjusted EBITDA is expected to be around €1.6 billion.

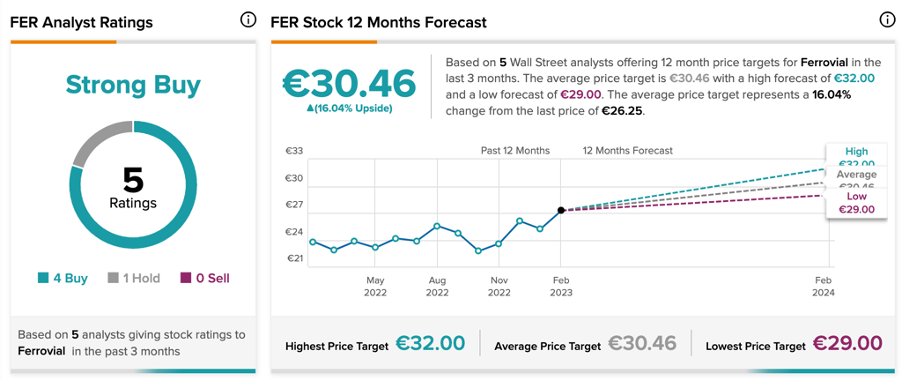

Is Ferrovial a Buy?

FER stock has a Strong Buy rating on TipRanks, with an average target price of €30.46, suggesting an upside of 16.04%.

Grifols, S.A.

Grifols is a Spanish pharmaceutical company specializing in blood plasma-based products. The company is on the recovery path after its plasma business struggled during the pandemic.

The company will report its fourth quarter and full-year results for 2022 on February 28. Analysts expect an EPS of €0.14 in Q4, which shows a significant improvement over the negative EPS of €0.12 in Q4 2021. The sales forecast for this quarter is €1.56 billion.

Analysts remain bullish on its earnings and long-term prospects, based on its cost control measures, expected growth in plasma collections, and cash flow generation. In the first nine months of 2022, the plasma collection volumes increased by 25%. This number is further expected to grow in Q4 and beyond, driven by its recent acquisitions of plasma centers.

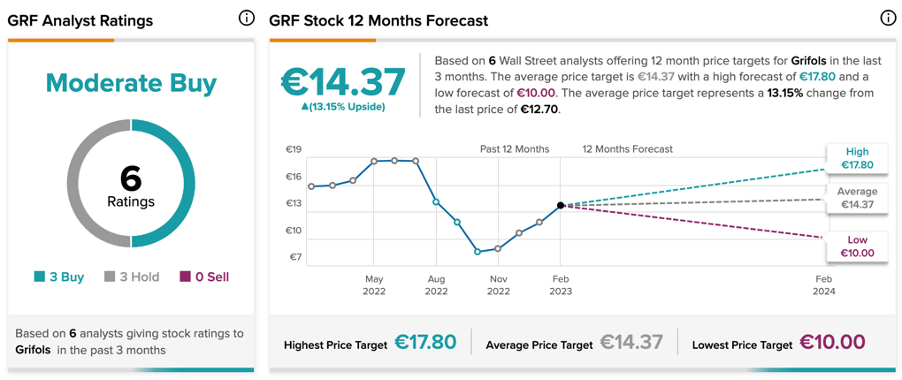

Grifols Stock Forecast

According to TipRanks, GRF stock has a Moderate Buy rating, based on three Buy and three Hold recommendations.

The average target price for GRF is €14.37, which is 13.15% higher than the current price.

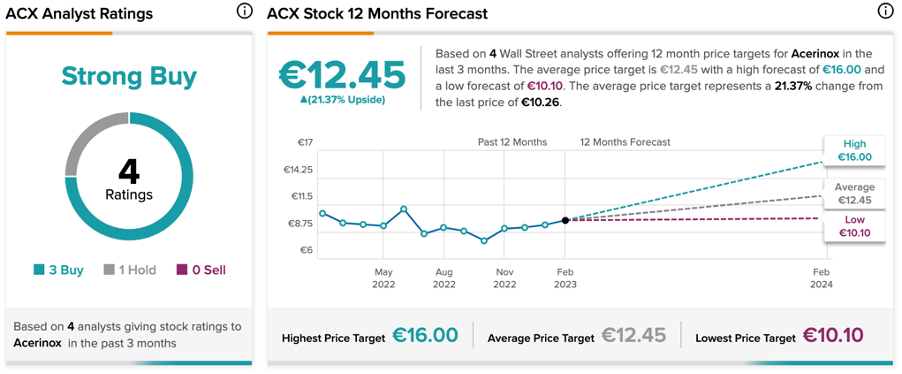

Acerinox SA

Acerinox is one of the largest manufacturers of stainless steel in the world, selling its products in more than 80 countries.

The company will announce its 2022 financial results tomorrow, February 28. According to the TipRanks database, the EPS forecast for the fourth quarter is €0.18.

Overall, ACX stock has a Strong Buy rating, based on three Buy and one Hold recommendations. The target price of €12.45 implies an upside of 21.37% from the current level.

Solaria Energia y Medio Ambiente, S.A.

Solaria is engaged in the development of solar energy in Europe through solar panels and solar plants.

The company will report its Q4 results tomorrow. Solaria will also announce its full-year numbers for 2022. Analysts expect Q4 EPS to come in at €0.05. The sales forecast for Q4 is €45.52 million.

SLR stock has a Moderate Buy rating on TipRanks based on two Buy recommendations. The target price is €21.25, which is 23% higher than the current trading levels.

Conclusion

These four Spanish stocks could be good additions for investors looking to diversify their portfolios. While analysts are waiting for the final numbers from these companies, they are also confident about the upside in their share prices in the near term.