Spanish companies Industria de Diseño Textil, S.A. (ES:ITX) and Iberdrola, S.A. (ES:IBE) have made their shareholders happy in the last year. Analysts remain confident in their outlook and have rated them as Buy.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While choosing such stocks from different sectors within one market, the TipRanks Stock Comparison tool is a good way to get started. Via this tool, a user can screen the stocks based on different parameters and compare them accordingly.

Let’s discuss these companies in detail.

Industria de Diseño Textil, S.A. (Inditex)

Inditex is a clothing company with brands like Zara, Pull & Bear, Massimo Dutti, etc. in its portfolio. The company operates in around 215 markets globally.

As evidenced by the company’s annual earnings, the company experienced a strong recovery in 2022 as customers started to shop in stores again.

The sales in Q4 increased by 13% as compared to the same quarter a year ago. For the full year, sales increased by 17.5% to €32.6 billion, driven by 23% more shoppers in its stores. The company also benefited from higher online sales in 2022, which even continued in 2023. The net profit for the year was €4.1 billion, up from €3.2 billion in 2021.

Following such record numbers, analysts are optimistic about the stock. They believe the company’s logistics management, higher prices, store expansion, and automation will drive solid growth ahead.

Analyst James Grzinic from Jefferies commented, “The new year has started in remarkably strong fashion in top-line terms.” Grzinic has a Buy rating on the stock at a target price of €33.0, indicating an upside of 16.4%.

Inditex Stock Price Target

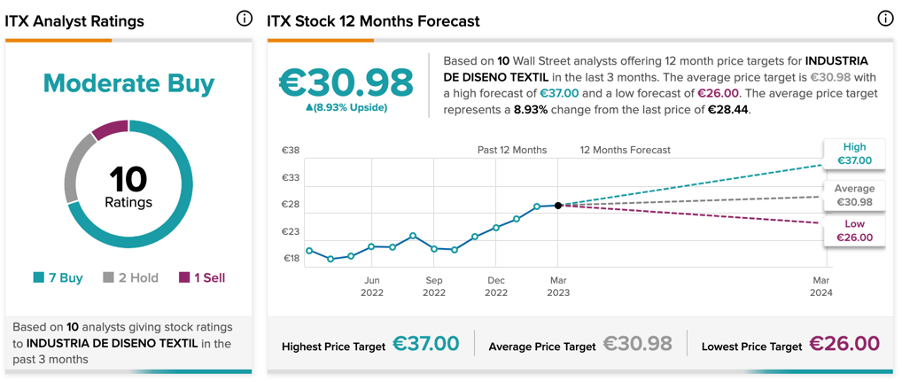

Based on a total of 10 recommendations, ITX stock has a Moderate Buy rating on TipRanks.

The average target price is €30.98, which is 9% higher than the current price.

Iberdrola, S.A.

Iberdrola is a leading utility company devoted to clean and renewable energy solutions.

In February, the company reported its 2022 annual results with higher profits. The company’s net profits increased by 12% to €4.34 billion, mainly due to solid performances in the U.S. and Brazil. The higher numbers in these regions compensated for the performance in Spain and the EU. The earnings jumped by 10% to €13.23 billion, as compared to the previous year.

The company’s investments during the year grew by 13% on a year-over-year basis to €10.7 billion, which was mostly allocated to networks and renewables.

Moving forward, the company is targeting a net profit growth of 8-10% in 2023. It also expects to grow its earnings by 10% annually as governments across the world promote sustainable energy.

What is the Price Prediction for Iberdrola?

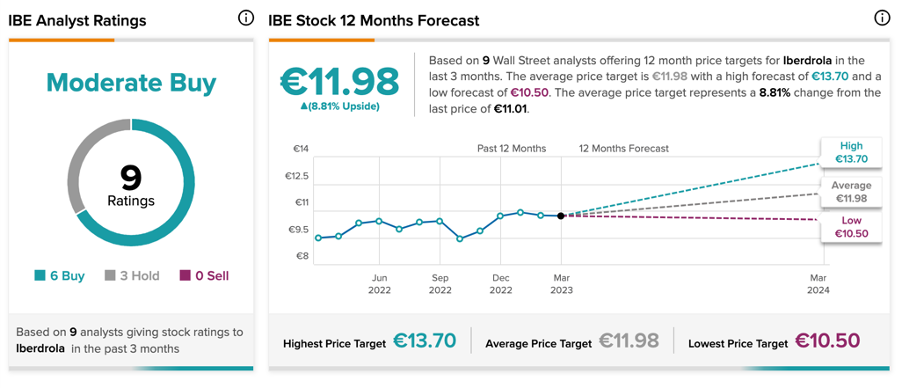

According to TipRanks’ analyst consensus, IBE stock has a Moderate Buy rating, based on six Buy, and three Hold recommendations.

The average target price is €11.98, which represents an 8.8% change in the price from the current level.

Conclusion

Inditex and Iberdrola have reported solid numbers in their 2022 annual results.

Analysts remain bullish on Inditex’s future top-line growth as more and more customers return to store shopping.

As for Iberdrola, analysts are looking at higher investments and higher earnings for the company, pushed by the sustainable energy drive by governments worldwide.