In key news on Hong Kong stocks, electric vehicle (EV) manufacturer Xpeng, Inc. (HK:9868) is seeking a larger mass market share with the launch of its affordable EV brand. This move is in response to the ongoing price war in China’s EV market and part of the company’s efforts to grab some market share from industry giant BYD Co. Limited (HK:1211).

Xpeng shares opened in the green zone on Monday and surged by more than 5% at the time of writing. Year-to-date, the stock is down by 29%.

Xpeng is a Chinese smart EV company leading the transformation with innovative technology.

Navigating the Rising Competition

Competition in China’s EV market has intensified, led by BYD, which is driving a new wave of price reductions. BYD currently dominates the affordable market segment with multiple models, prompting other premium EV companies to target this segment as well.

Xpeng’s affordable brand is set to launch within the next month. The company will introduce a compact EV in the Class A category, priced between ¥100,000 and ¥150,000, compared to the average range of ¥200,000 to ¥300,000 in the market.

The new brand is also committed to developing AI-assisted driving for customers with autonomous driving systems. The company aims to drastically reduce its production costs this year, including bringing down costs related to intelligent driving systems by 50%. Xpeng plans to leverage its expertise in intelligent driving and cost management to integrate advanced smart driving features from high-end EV models into more affordable ones.

Is it a Good Time to Buy XPeng Stock?

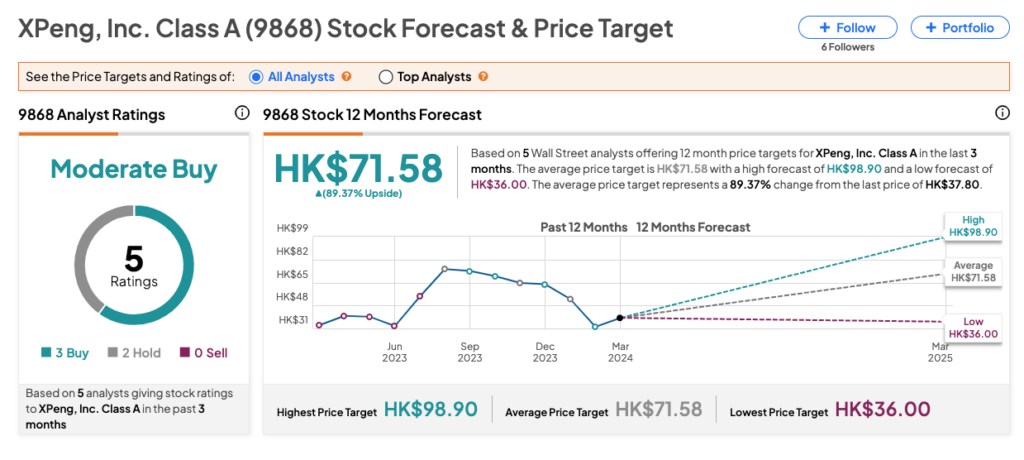

On TipRanks, 9868 stock has received a Moderate Buy consensus rating from analysts, based on three Buy and two Hold recommendations. The XPeng share price forecast is HK$71.58, which implies a huge upside of almost 90% from the current level.