In major news on Hong Kong stocks, Samsonite International S.A (HK:1910) shares plunged nearly 9% following the announcement of the board’s approval for a dual listing apart from the HKEX. This move aims to enhance liquidity and expand investor access across multiple markets. The company refrained from disclosing further details as the move was still in its early stages. Year-to-date, the stock has gained over 11% in trading.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Samsonite is a prominent lifestyle brand that specializes in the manufacturing and retailing of travel luggage.

Samsonite Dual Listing: Eyeing New Investors

The dual listing will allow Samsonite to expand its reach to investors in other key markets, which is crucial for its global expansion and business growth. Additionally, amid declining valuations in Hong Kong, companies are looking for multiple options to attract investors.

Earlier this year, Reuters reported that the company was also exploring options to go private. These discussions also highlight the ongoing regulatory concerns due to tensions between the U.S. and China. Various multinational companies listed in China are apprehensive about potential sanctions by the U.S. Based on these assumptions, the U.S. could be the potential venue for the second listing.

Samsonite Shines Bright in 2023

Last week, Samsonite reported its annual result for 2023, showcasing an impressive set of numbers. The company’s consolidated net sales surged by 30% year-over-year, excluding currency effects. The company’s sales were fuelled by the ongoing rebound in leisure and business travel worldwide, leading to higher demand for its products.

The gross profit margin and adjusted EBITDA margin both hit all-time highs, underscoring its efficient cost management. As a result, the adjusted EBITDA grew by 50% to $709.3 million in 2023, compared to the previous year.

What is the Share Price Forecast for Samsonite?

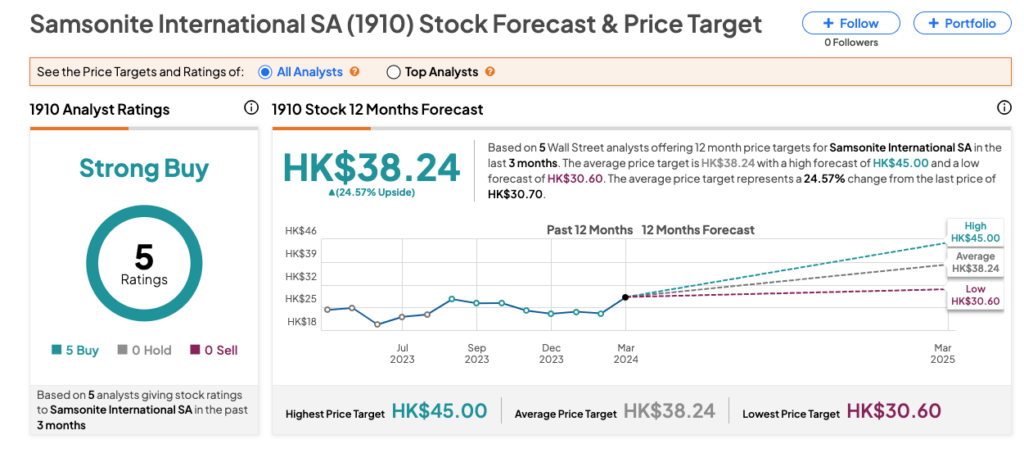

As per the consensus rating on TipRanks, 1910 stock has received a Strong Buy rating, supported by all Buy recommendations from five analysts. The Samsonite share price forecast stands at HK$38.24, signifying a potential upside of 25% from the current level.