Among the major news on Hong Kong stocks, NetEase (HK:9999) (NASDAQ: NTES) has rallied by over 4% after Beijing approved 104 new domestic video games. In June, China’s gaming regulator, the NPPA (National Press and Publication Administration), approved 92 mobile games along with 12 cross-platform games. These included NetEase’s ‘Epic of Tiara’ along with Tencent Holdings Limited’s (HK:0700) ‘Roco Kingdom: World’ and ‘Ruyuan’ from Alibaba Group’s (HK:9988) studio Lingxi Games.

Alibaba shares gained 0.34% as of the time of writing, while Tencent was down by 0.58%.

NetEase is a technology company that develops online PC and mobile games, smart devices, e-commerce platforms, and other solutions.

China’s Gaming Outlook

China’s latest round of approvals signals a revival for its video game industry, which suffered a regulatory crackdown since late 2021. These approvals suggest that the licensing process has returned to its normal operations, leading to recovery in the video games market.

In 2023, NPPA approved a record 1,075 new games, demonstrating strong support for the industry’s growth. In January 2024, China’s video game industry saw its highest monthly approvals in years, with 115 licenses granted, setting a strong start.

Looking ahead, Citi forecasts that China will approve 1,200-1,400 new games this year, indicating stable regulations. Meanwhile, Jefferies analysts believe the NPPA remains committed to fostering the prosperous and healthy development of the online game industry.

Is NetEase a Good Stock to Buy?

NetEase stock has experienced a rollercoaster ride amid shifts in Chinese regulatory policies, gaining 1.4% over the past 12 months. In December 2023, NetEase’s shares took a significant hit when Beijing announced stricter guidelines on online gaming. However, the shares later rebounded as regulators eased their stance on these proposals.

Nonetheless, analysts are highly optimistic about NetEase’s gaming revenue, considering the company’s successful existing titles, a promising lineup of new games, and overseas expansion of games in multiple languages.

In the first quarter of 2024, the company’s net revenues from games and value-added services amounted to ¥21.5 billion, marking a year-over-year growth of 7%. NetEase’s recent launches, such as She Diao and Naraka: Bladepoint Mobile, alongside existing titles like Eggy Party, Racing Master, and Dunk City Dynasty, are anticipated to drive further revenue growth for the company.

NetEase Share Price Target

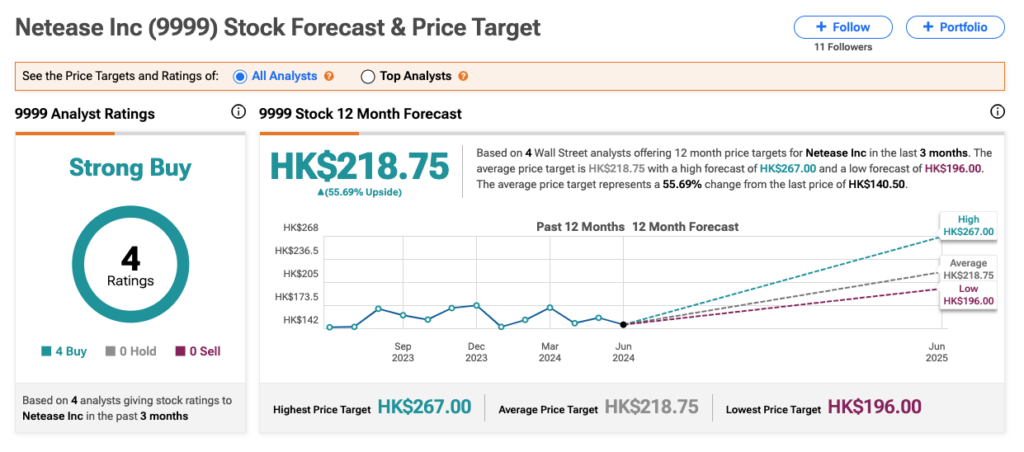

On TipRanks, 9999 stock has received a Strong Buy rating, supported by unanimous Buy recommendations from four analysts. The NetEase share price target of HK$218.75 implies an upside of 56% from the current level.

Questions or Comments about the article? Write to editor@tipranks.com