In major news on Hong Kong stocks, Li Ning Co. Limited (HK:2331) shares gained 5.71% on Tuesday, after the company released its Q1 update for FY24, disclosing mixed results. The company’s retail performance in the first quarter met expectations, however, same-store sales underperformed. Li Ning shares are down by 67.5% in the last 12 months.

Li Ning is a leading Chinese sports brand, founded by former Olympic gymnast Li Ning. The company manufactures and sells apparel, footwear, and other sports equipment.

Insights from Li Ning’s Q1 Update

In Q1, the retail sell-through of the Li Ning point of sale (excluding Li Ning Young) across the entire platform witnessed a low-single-digit increase compared to the previous year.

Among its channels, retail grew by a mid-single-digit percentage, while wholesale business decreased by a mid-single-digit rate on a year-over-year basis. E-commerce witnessed a strong low-twenties growth.

Coming to Li Ning’s same-store-sales, the overall platform experienced a mid-single-digit decline compared to the previous year. Specifically, the retail channel saw a low-single-digit decline, while the wholesale channel posted a higher decline in the mid-teens.

Analysts’ Reactions

Post-update, analyst Cathy Xiao from Nomura reduced her price target on Li Ning stock from HK$33.2 to HK$30.0, while maintaining a Buy rating. Nomura anticipates that the company’s sales will gradually rebound in the second half of 2024. The company expects to remain on course to achieve its full-year target of mid-single-digit year-over-year sales growth.

On the other hand, J.P. Morgan analyst Qian Yao maintained a Sell rating on Li Ning stock, predicting a downside of 20%. J.P. Morgan called the update “mixed” and expressed concerns over the sluggish demand in China in the short term. The broker believes that the rising competition could put a dent in Li Ning’s sales and earnings, possibly leading to higher expenses.

What is the Target Price for Li Ning Stock?

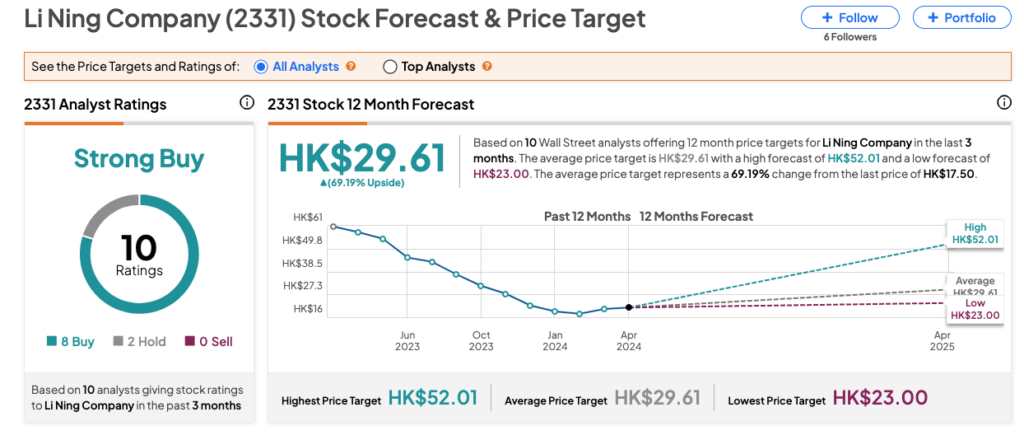

As per the consensus rating on TipRanks, 2331 stock has received a Strong Buy rating, supported by eight Buy and two Hold recommendations. The Li Ning share price forecast stands at HK$29.61, signifying a huge potential upside of 69% in the share price.