Among the famous Hong Kong stocks, Tencent Holdings Limited (HK:0700) remains a preferred choice among investors, with a Strong Buy rating from analysts. Recently, analyst Thomas Chong from Jefferies reiterated his Buy rating on the stock and raised the price target from HK$480 to HK$484. The new price predicts a growth rate of almost 22%.

Here, we have used the TipRanks Daily Analyst Rating tool for the Hong Kong market to identify Tencent stock. This tool compiles a list of stocks recently rated by analysts across various markets. It serves as a guide for users to choose stocks that are on analysts’ radar and carry Buy ratings.

Tencent Holdings provides digital entertainment and internet value-added services to over 1 billion users.

Here’s Why Jefferies Is Bullish on Tencent

Jefferies is bullish on Tencent’s stock mainly due to its confidence in the company’s Gaming and Advertising revenue, which are expected to drive growth. Chong has maintained his revenue forecast for 2Q24, projecting an 8% increase. Additionally, Jefferies expects Tencent’s non-GAAP net profit to increase by 26% year-over-year to ¥47 billion in 2Q24.

According to Jefferies, Tencent’s new mobile game, ‘Dungeon & Fighter Mobile,’ launched in May in China, has done better than expected, leading to a positive outlook. Chong also emphasized that the company’s efforts to revive its existing gaming portfolio should drive growth.

Within its segments, Domestic and International Games revenues are expected to grow approximately 6% year-over-year, up from the earlier estimate of 3%. Meanwhile, Online Advertising revenue is projected to grow around 17% year-over-year, compared to the previous estimate of 15%, attributed to enhanced advertising infrastructure and stronger video accounts.

In Q1 2024, Tencent reported its fifth consecutive quarter of revenue growth. Total revenues reached ¥159.5 billion, reflecting a 6% year-over-year increase, and profits increased by 54% to ¥51.3 billion.

The company will publish its second-quarter results for 2024 on August 14.

Is Tencent a Good Stock to Buy?

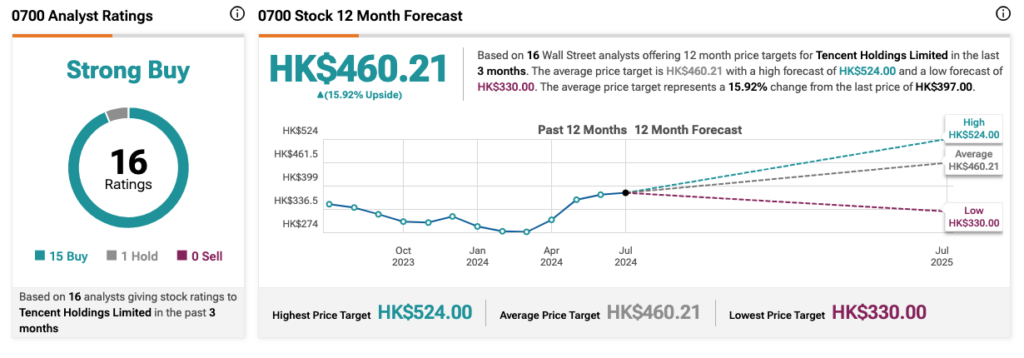

According to TipRanks’ rating consensus, 0700 stock has received a Strong Buy rating, backed by 15 Buy and one Hold recommendation. The Tencent share price forecast is HK$460.21, which implies an upside of 16% on the current trading level.