In key news on Hong Kong stocks, JD.com, Inc. (HK:9618) is targeting to raise $1.75 billion through the offering of convertible senior notes, increasing the initially announced offer. The company intends to utilize the raised funds to repurchase some of JD.com’s shares, fund its overseas business expansion, improve its supply chain, and cover working capital expenses. JD.com’s Hong Kong-listed shares were trading down by 1.9% as of writing.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

JD.com is a leading e-commerce platform in China, offering products such as electronics, home appliances, and groceries.

More Details About JD.com’s Offer

JD.com’s notes, which will mature on June 1, 2029, carry an annual interest rate of 0.25%, with payments made twice a year. The notes offering, directed at qualified institutional buyers and select non-U.S. persons, provides an option to initial purchasers to buy up to an additional $250 million in notes within 30 days.

Noteholders can convert their notes into cash, American depositary shares (ADS), or a mix of both at the company’s discretion.

Alongside the notes offering, JD.com plans to buy back around 14 million ADS, aiming to balance out any potential dilution resulting from note conversions. These buyback actions could impact both the market price of the ADS and the trading value of the notes.

The company aims to finalize the notes offering around May 23, 2024, contingent upon the fulfilment of standard closing requirements.

JD.com’s Q1 2024 Results Snapshot

Last week, JD.com reported favourable results for its first quarter of 2024, surpassing estimates. In the quarter, the company reported an earnings per share (EPS) of ¥5.65, exceeding analysts’ expectations of ¥4.69. Revenue reached ¥260.05 billion, a 7% year-over-year increase, also beating the consensus estimate of ¥258.03 billion.

The company’s focus on execution resulted in operational efficiencies and strong user growth, which positively impacted overall performance. Net income attributable to shareholders rose by 13.9% to ¥7.1 billion.

Is JD Stock a Good Buy Now?

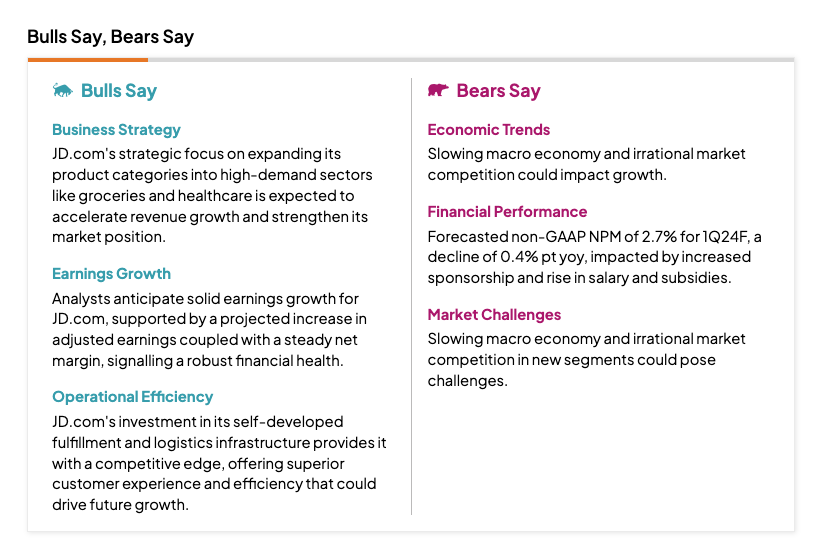

Analysts remain highly bullish on the 9618 stock, as reflected in the Strong Buy rating on TipRanks. As per the TipRanks Stock Analysis tool’s “Bulls Say, Bears Say” feature, analysts like the company’s strategy to shift towards high-demand sectors and its solid infrastructure, which could boost future growth.

The JD.com share price target is HK$174.86, which implies an upside of 32.5% from the current price level.