Hong Kong-listed Longfor Group Holdings Limited (HK:0960) and China Resources Land Ltd. (HK:1109) are trading at higher values today following China’s recent efforts to boost the sluggish housing market. Yesterday, Beijing and Shanghai introduced a new set of actions, which included extending repayment deadlines and trimming the down payment ratios.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Effective immediately, Beijing is reducing the minimum deposit ratio from 35%-40% to 30%. Additionally, the maximum term for personal housing loans is being extended from 25 to 30 years, along with a decrease in the floor rates for new mortgages. In Shanghai, the minimum deposit ratio for a first home will be 30%, down from 35%.

Longfor and China Resources are well-known property development and management companies in China. Longfor’s stock gained 6.3% today, while China Resources’ share price traded up by 5.85% on Friday. This led to a substantial 4.8% increase in an index monitoring Chinese developers.

China’s Struggling Housing Market

Post-COVID-19, China has encountered challenges in its housing market and a slowdown in its economic activities, hurting investors’ confidence in the economy’s recovery.

The recent measures came in response to the deteriorating situation of the country’s housing sector. According to the data from the National Bureau of Statistics (NBS), housing prices experienced a decline in November, marking the fifth consecutive month of decline. The country is also making efforts to speed up the development of affordable housing projects.

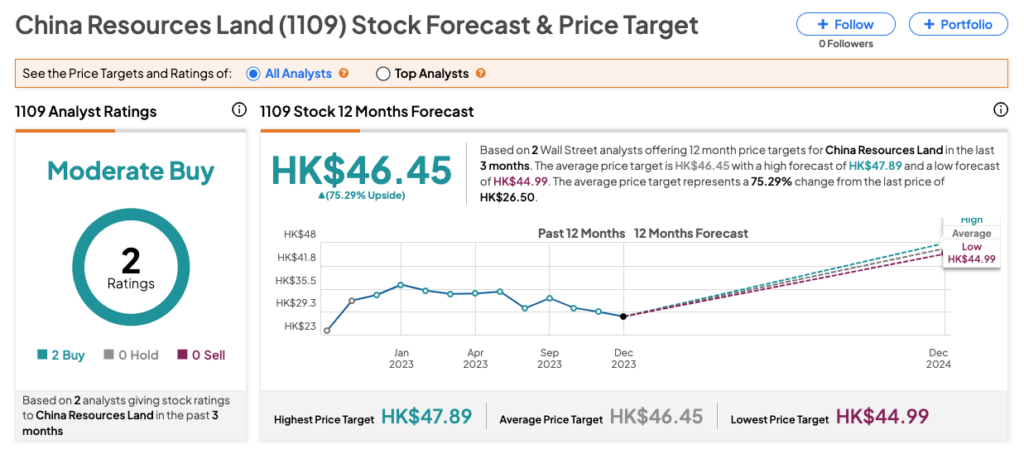

Let’s take a look at analysts’ ratings for China Resources stock

China Resources Share Price Target

As per the consensus rating on TipRanks, 1109 stock has received a Moderate Buy rating based on two Buy recommendations. The share price forecast is HK$46.45, signifying a potential upside of 75% from the current level.