In major news on Hong Kong stocks, electric vehicle (EV) maker BYD Co. Limited (HK:1211) has proposed a ¥400 million share buyback plan and unveiled an ultra-premium EV model. Chairman and CEO Wang Chuanfu has decided to double down on the company’s initial ¥200 million share repurchase plan of Class A shares to boost shareholder value and enhance investor confidence. The news pushed 1211 shares nearly 2% higher.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

More About the CEO’s Announcement

Shares repurchased under BYD’s new plan will be used for employee stock options, share incentives, or to reduce the company’s outstanding share capital. Chuanfu is trying to lure investors at a time when BYD’s stock price has lost over 12% in the past year. A reduced float will enable shareholders to earn higher per share returns.

China’s EV maker dethroned Tesla (NASDAQ:TSLA) as the top EV company in the fourth quarter of 2023. Chinese EV makers are in the midst of an intense price war and uncertain macro conditions. Even so, BYD is confident about maintaining its number one spot as the biggest EV seller in China even this year, as it sees continued demand for premium EVs.

Meanwhile, BYD launched its latest high-performance, all-electric supercar, Yangwang U9, on February 25, at a price of about ¥1.7 million. The car is placed in the premium category to compete with gas-powered models of rivals Ferrari and Lamborghini. The U9 will initially be launched only in the Chinese market. BYD is also set to launch other expensive EVs under the premium Yangwang brand later this year.

Is BYD Stock a Good Buy?

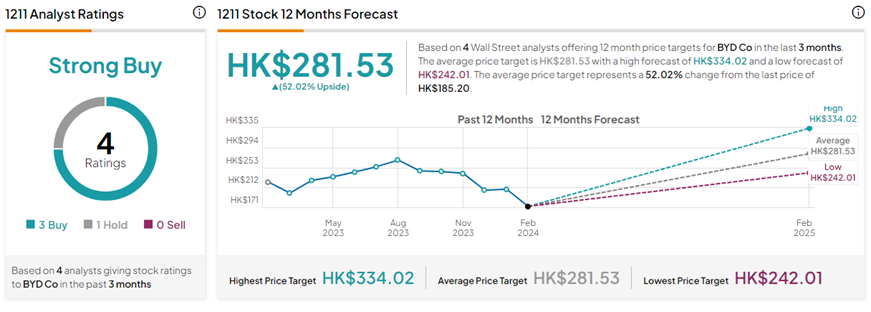

On TipRanks, 1211 stock commands a Strong Buy consensus rating, backed by three Buys and one Hold rating. The BYD Co. Limited share price forecast of HK$281.53 implies 52% upside potential from current levels.