Among the prominent Hong Kong stocks, NetEase (HK:9999) (NASDAQ:NTES) continues to garner a bullish stance from analysts amid its robust gaming growth. Despite the recent release of the company’s mixed Q1 2024 results, analysts at Nomura and DBS have maintained their Buy ratings on the stock. Analysts are highly optimistic about the company’s gaming revenue, crediting its success to both NetEase’s established titles and the promising lineup of new games.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Year-to-date, NetEase stock has been trading down by 3.56%.

NetEase is a technology company that specializes in developing online PC and mobile games, smart devices, e-commerce platforms, and various other digital services.

NetEase’s Q1 Performance

For the first quarter of 2024, NetEase’s net revenues reached ¥26.9 billion, marking a 7.2% increase compared to the first quarter of 2023. This slightly missed the analysts’ estimate of ¥26.97 billion.

Among its segments, the company’s net revenues from games and related value-added services increased by 7.0%, reaching ¥21.5 billion. Meanwhile, Youdao (NYSE:DAO), the company’s intelligent learning segment, saw a substantial revenue increase of 19.7%, while Cloud Music’s net revenues grew by 3.6%.

DBS’ Bullish Perspective

Last week, analyst Tsz Wang from DBS reiterated a Buy rating on NetEase stock, predicting a huge upside of 88%. Wang foresees the company attaining a CAGR (compound annual growth rate) exceeding 10% between 2023 and 2026 in its online gaming revenue.

He believes the company’s legacy tiles, such as Eggy Party, Racing Master, and Dunk City Dynasty, will sustain online game revenue growth in the future. Also, the upcoming pipeline, including Naraka: Bladepoint, Where Winds Meet, and the return of Blizzard titles, will further support the top line.

Additionally, Wang sees the company’s global expansion as a key growth driver. The company is set to unveil its popular game Eggy Party in more than 10 languages later this year. Wang predicts a CAGR of 24% in overseas gaming revenue from 2023 to 2026.

Nomura Recommends NetEase

Meanwhile, analyst Jialong Shi from Nomura also confirmed a Buy rating on NetEase stock yesterday. Nomura highlighted NetEase’s reliable track record of introducing new games and sustaining the popularity of its flagship titles over time.

Shi expects the launch of Where Winds Meet on PC and Naraka: Bladepoint on mobile platforms during this year’s summer holiday season to be the key drivers for gaming and share price growth.

What is the Price Prediction for NetEase?

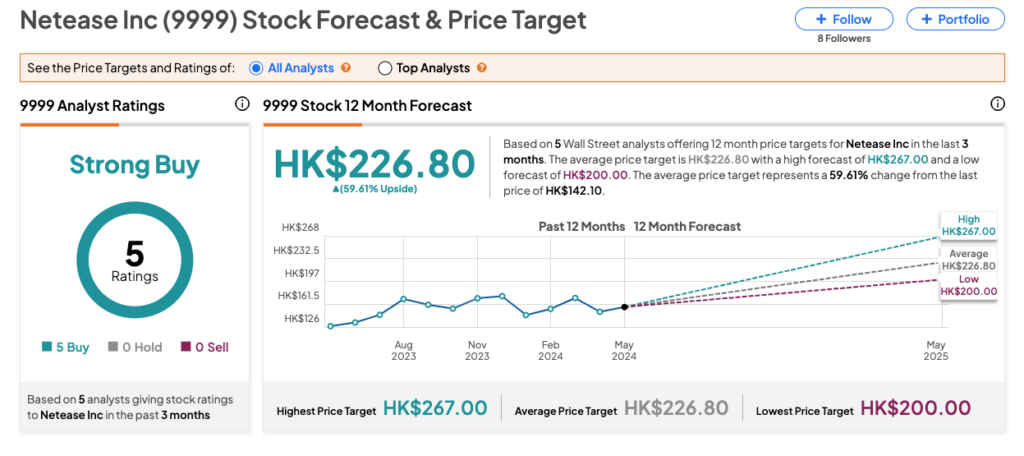

On TipRanks, 9999 stock has received a Strong Buy consensus rating, backed by all five Buy recommendations. The NetEase share price target is HK$226.80, which implies an upside of 60% from the current level.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue