Among major Hong Kong stocks, Meituan Dianping (HK:3690) continues to enjoy a Strong Buy rating from analysts. Finding a promising investment among numerous stocks can be challenging. TipRanks’ analyst recommendations, including Hold, Buy, and Sell reviews, offer valuable guidance for making informed decisions when choosing stocks.

Meituan is a leading e-commerce platform connecting consumers and merchants. The company offers consumer products and other services like food delivery, entertainment, travel, etc.

Let’s take a look at the details.

Meituan’s Share Price Story

In 2023, Meituan shares had a challenging year, with a slowdown in the food delivery business and growing competition. As a result, the stock went down by over 55% last year.

Year-to-date, the shares have rebounded significantly, rising approximately 50%. The stock’s upward trajectory was largely fueled by the company’s announcement of an organizational restructuring in February, aimed at reviving its share price. As part of this, Meituan will integrate its two primary business groups, to-home, and in-store, along with its two central departments, platforms, and R&D. With this move, the company aims to promote synergy between these businesses, resulting in higher operational efficiency.

Additionally, the upbeat holiday data from the Chinese Lunar New Year in February also helped Meituan shares. The data suggests that consumption patterns have rebounded despite the property crisis in China.

Recent Ratings on Meituan Stock

Overall, analysts maintain a positive outlook on Meituan stock, considering its dominant position in China, where it holds 70% of the online food delivery market.

Last month, analyst Charlene Liu from HSBC reiterated a Buy rating on the stock, predicting a growth rate of 38.5%. The analyst believes that the company’s ongoing dominance in the food delivery sector and the possibility of reduced competition in the in-store business could drive the stock higher.

Before that, Goldman Sachs analyst Ronald Keung stated that the market holds an “overly negative” view regarding the impact of competition. He also emphasized the substantial growth in transaction volumes and profits within Meituan’s food delivery segment over the past five years. Keung has a Buy rating on the stock with a forecast of 17% upside.

Is Meituan a Good Stock to Buy?

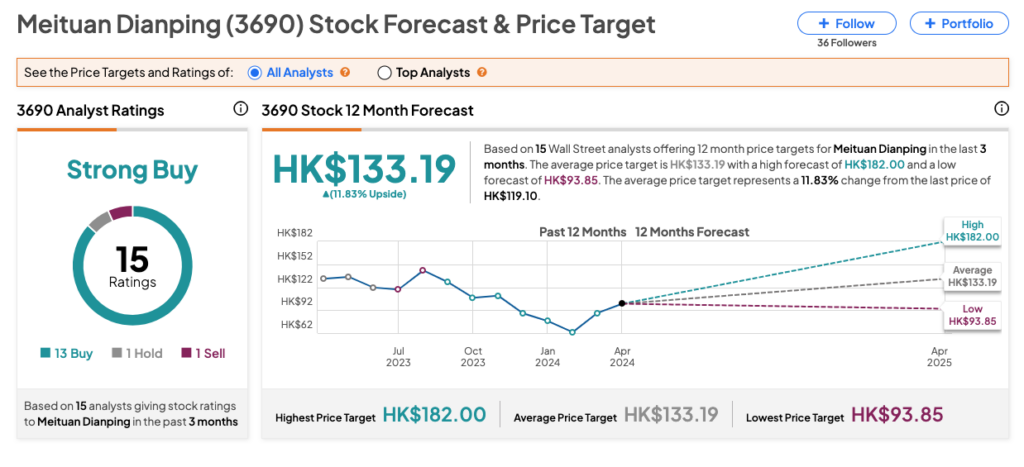

On TipRanks, 3690 stock has received a Strong Buy rating from analysts based on 13 Buys, one Hold, and one Sell recommendation. The Meituan share price target is HK$133.19, which shows a growth rate of 12% on the current trading price.