In key news on German stocks, Volkswagen AG (DE:VOW) is reportedly mulling a sale of €1 billion worth of stock in its subsidiary company Traton SE (DE:8TRA). This move aims to capitalize on Traton’s rising price by offering more shares for trading. Traton is a leading commercial vehicle manufacturer. Its shares have surged by a substantial 78% in the last six months, mainly driven by its robust 2023 performance and optimistic prospects for 2024.

More Details on Volkswagen’s Potential Sale

According to Bloomberg, Volkswagen has been in discussions with potential advisors regarding a sale to institutional investors through an accelerated book-building transaction, which could happen in the upcoming weeks. The offering size could range between €500 million and €1 billion, contingent upon prevailing market conditions.

Following Traton’s IPO in 2019, investors have urged Volkswagen to expand the truck maker’s free float. This move would allow Traton to secure additional funding and enhance its independence as a business unit. The potential sale represents a 6% stake for Volkswagen, which currently owns around 90% of Traton.

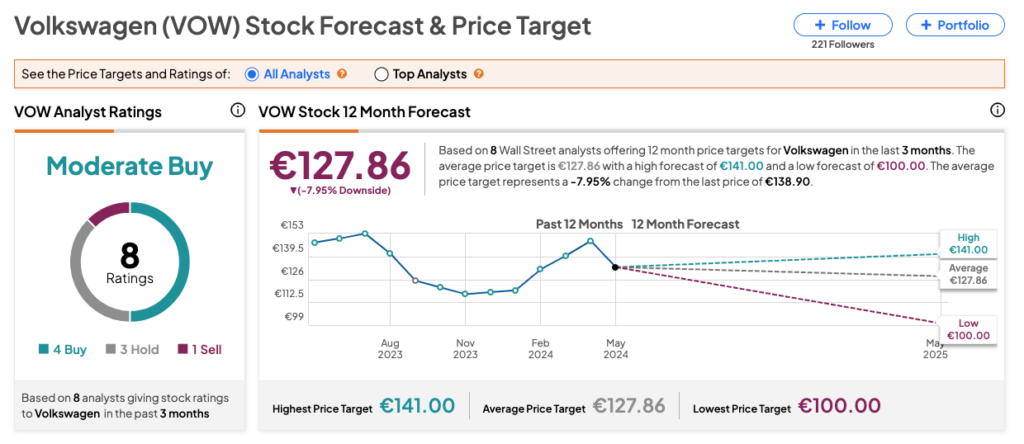

Is VW a Good Stock to Buy Now?

According to TipRanks’ consensus, VOW stock has received a Moderate Buy rating based on recommendations from eight analysts. This includes four Buys, three Holds, and one Sell rating. The Volkswagen share price forecast is €127.86, which is 8% below the current price level.

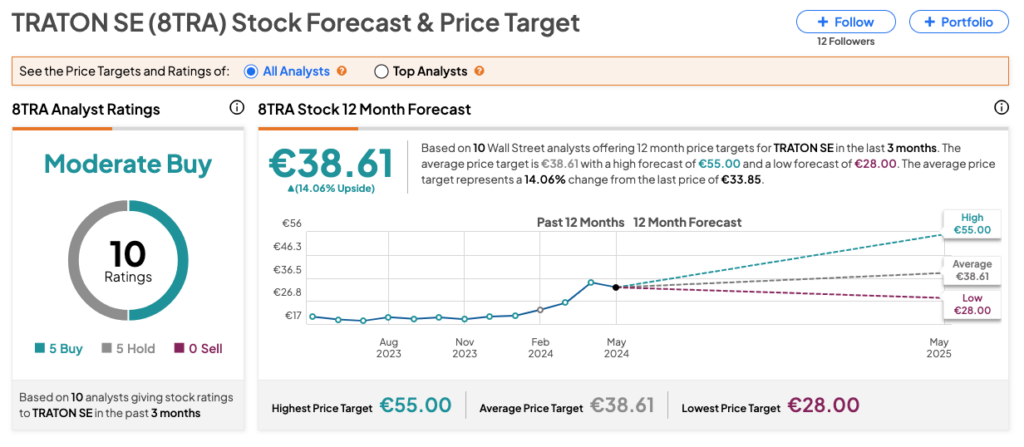

Is Traton a Buy or Sell Stock?

Traton’s shares, on the other hand, offer an upside of 14% at an average price target of €38.61. 8TRA stock also carries a Moderate Buy rating on TipRanks, backed by five Buy and five Hold recommendations.