German insurance companies E.ON SE (DE:EOAN), Bayerische Motoren Werke AG (DE:BMW), and Volkswagen AG (DE:VOW3) will release their earnings for 2022 this week.

According to analysts, E.ON and Volkswagen have Moderate Buy ratings, while BMW has a Hold rating.

The TipRanks Earnings Calendar tool, which is available in seven countries, provides updated information on the companies, including their earnings date, EPS, sales forecast, etc. The tabular representation of the data points makes it easy for investors to get a quick summary of the details.

Let’s have a look at these companies in detail.

E.ON SE

E.ON SE is among the leading energy companies in Europe, serving around 51 million customers.

The company will report its 2022 annual report along with Q4 numbers on March 15. According to TipRanks, the consensus EPS forecast is €0.08 per share for the fourth quarter. This number is lower than the EPS of €0.12 per share in the same quarter of 2021. The company targets growth of 7-9% CAGR in its EPS over the next three years.

For the first three quarters of 2022, the company saw a strong operational recovery in all its markets, which is expected to continue. The EBITDA outlook for 2022 is between €6.7 and €6.9 billion.

E.ON Share Price Forecast

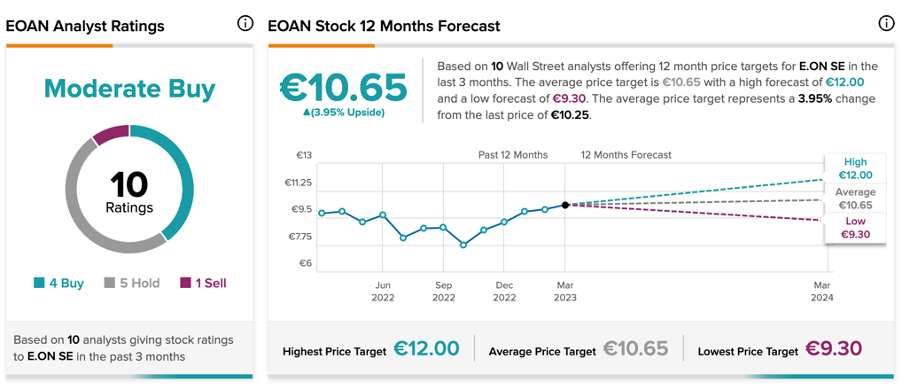

According to TipRanks’ rating consensus, EOAN stock has a Moderate Buy rating. The stock has a total of 12 recommendations, out of which four are Buy.

The average price forecast is €10.65, which shows an upside of 4% from the current price.

Bayerische Motoren Werke AG

The luxury car manufacturer, BMW, will also announce its 2022 earnings on March 15. The forecasted EPS for the fourth quarter is €3.82 per share on TipRanks.

Last week, the company already announced its preliminary numbers for the year, meeting its targets. The company’s earnings were up 46.4% and its net profit was up 49% in 2022, as compared to the previous year. The total revenues jumped by 28% to €142.6 billion in 2022. The company is betting big on its electric vehicle sales, which grew by 107.7% in 2022.

BMW proposed a dividend of €8.5 per share for 2022.

BMW Share Price Target

Analysts have mixed views on the BMW stock and a Hold rating on TipRanks. This is based on a total of 12 recommendations.

The average target price is €94.37, which is 3.49% lower than the current price. The stock has been trading up by more than 40% in the last year.

Volkswagen AG

Another leading automobile manufacturer from Germany, Volkswagen, will also report its results this week. The company will release its fourth quarter and full-year numbers for 2022 on March 14. According to TipRanks, the consensus EPS forecast is €8.38 per share for Q4.

The company’s preliminary numbers for 2022 painted a good growth story with an even brighter outlook for 2023. The sales were up by 12% year-over-year to €279.2 billion in 2022, with an overall 7% decline in deliveries offset by higher prices. With its strict cost control measures, the company was able to push its operating profit to €22.5 billion, which increased by 13% from 2021.

The company also impressed shareholders with an increase of €1.2 per share in its dividends to €8.7 per share in 2022.

Moving forward, the company’s outlook looks favorable, sitting on a strong order book and growing EV market share.

Is Volkswagen a Buy Now?

According to TipRanks, VOW3 stock has a Moderate Buy rating based on six Buy, four Hold, and one Sell recommendations.

The target price of €170.7 suggests an upside of 26.6% from the current price.

Conclusion

While the preliminary numbers for both BMW and Volkswagen look impressive, analysts are more bullish on the VOW3 stock, which has a Moderate Buy rating.

As for BMW, the stock price has already been soaring over the last year, making it an expensive investment.

For E.ON, even though the expected growth is huge in the future, analysts don’t see much upside in the share price currently.