In news on German stocks, Evonik Industries (DE:EVK) announced its plans to cut 2,000 jobs globally by 2026 amid a gloomy outlook for 2024. The chemicals company aims to save around €400 million annually through these job cuts, primarily impacting positions in Germany. Evonik announced these job cuts along with its Q4 2023 results and stated that it does not expect any significant recovery this year.

Despite ongoing challenges, Evonik managed to meet its lowered forecasted numbers for 2023. EVK shares gained 0.15% in yesterday’s trading session.

Evonik operates on a global scale within the specialty chemicals sector, producing a range of additives for diverse industries.

Evonik Meets 2023 Forecast

Evonik achieved an adjusted EBITDA of €1.66 billion, falling within the targeted range of €1.6 billion to €1.8 billion. Sales declined by 17% to €15.3 billion, also landing within the targeted range of €14 billion to €16 billion. For 2024, the company expects sales between €15 billion and €17 billion.

J.P. Morgan analyst Chetan Udeshi believes the guidance numbers align with the consensus, which could provide some relief to investors. Post-results, Udeshi confirmed his Buy rating on the stock, predicting an upside of 45%.

Evonik reported a net loss of €465 million in 2023, primarily due to high impairments and costs from structural measures. The company’s volumes declined by 8% during the year. However, the company made its shareholders happy with an annual dividend of €1.17 per share, reflecting its strong cash flow position. In 2023, free cash flow totalled €801 million, surpassing the previous year’s figure.

Is Evonik a Good Stock to Buy?

Over the last 12 months, EVK stock has declined by more than 18%, as the company struggles with weak demand amidst challenging market conditions.

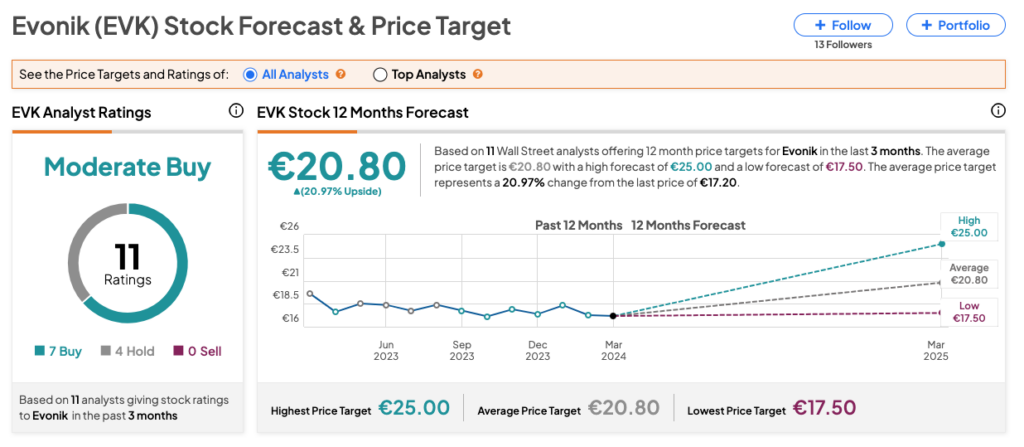

According to TipRanks, EVK stock has received a Moderate Buy consensus rating based on a total of 11 recommendations. It includes seven Buy and four Hold recommendations. The Evonik share price target is €20.80, which is 21% above the current trading level.